Everything You Need to Know About SME Finance Loan

Introduction to SME Finance Loans

Many economies are supported by small and medium-sized businesses (SMEs), which foster innovation, job creation, and local development. However, one of the biggest challenges SMEs face is access to capital. An SME finance loan can help these businesses thrive by providing individualized financial solutions. We’ll go over the intricacies of SME finance loans, their benefits, eligibility requirements, and how they can help businesses, especially in places like Hyderabad, in this blog. We’ll also go over the full definition of SME, what it means, and how SME finance companies help empower entrepreneurs.

What is an SME Finance Loan?

An SME finance loan is a specialized loan product designed to meet the financial needs of small and medium enterprises. These loans provide businesses with the capital required for various purposes, such as expanding operations, purchasing equipment, managing working capital, or investing in new technology. SME finance loans, in contrast to conventional loans, are designed to address the particular difficulties faced by smaller businesses. They offer flexible terms and competitive interest rates.

Understanding the Full Form of SME

SME stands for Small and Medium-Sized Enterprises. SMEs are businesses that fall below certain thresholds in terms of revenue, assets, or employee count, as defined by different countries or regions. According to the Micro, Small, and Medium Enterprises Development (MSMED) Act of 2006, SMEs in India are classified according to their annual turnover and investment in plant and machinery or equipment. Understanding the SME meaning is crucial for entrepreneurs seeking financial support, as it determines their eligibility for specific loan schemes.

Why SMEs Need Financing

Small and medium-sized businesses frequently operate with limited resources, making it challenging to scale up or maintain operations without external funding. Some common reasons SMEs seek finance include:

Working Capital: To handle day-to-day costs like rent, inventory, and salaries. Expansion: To open new branches, enter new markets, or increase production capacity.

Purchase of Equipment: Making an investment in machinery or technology to boost productivity. Debt Consolidation: To streamline multiple loans into a single, manageable payment.

By making credit accessible and affordable, an SME finance loan meets these requirements and enables businesses to expand without jeopardizing their cash flow.

Types of SME Finance Loans

SME finance loans come in various forms, each tailored to specific business requirements. Below are some popular types of SME finance loans:

Term Loans

Term loans are traditional loans with a fixed repayment schedule and interest rate. They are ideal for long-term investments, such as purchasing equipment or expanding facilities. Depending on the lender and the business’s financial situation, these loans typically last anywhere from one to ten years.

Working Capital Loans

Working capital loans are designed to cover short-term operational expenses, such as payroll, rent, or inventory purchases. During times of low cash flow, these loans ensure that businesses can continue to function normally.

Invoice Financing

Businesses can borrow against unpaid invoices with invoice financing. This type of SME finance loan is particularly useful for businesses with long payment cycles, as it provides immediate cash flow without waiting for clients to pay.

Equipment Financing

Businesses can borrow against unpaid invoices with invoice financing. This type of SME finance loan is particularly useful for businesses with long payment cycles, as it provides immediate cash flow without waiting for clients to pay.

Government-Backed Loans

In India, schemes like the Mudra Loan, PMEGP (Prime Minister’s Employment Generation Programme), and CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) provide collateral-free loans to SMEs. These government-backed initiatives make it easier for businesses to access affordable financing.

Benefits of SME Finance Loans

SME finance loans offer numerous advantages that make them an attractive option for small businesses. Here are some key benefits:

Flexible Repayment Options

SME finance loans, in contrast to conventional loans, frequently come with flexible repayment terms, allowing businesses to time repayments around their cash flow cycles. This flexibility reduces financial strain and helps businesses stay afloat during lean periods.

Quick Disbursal

Many SME finance companies prioritize quick loan disbursal, enabling businesses to address urgent financial needs. Some lenders offer online applications and approvals within 24-48 hours.

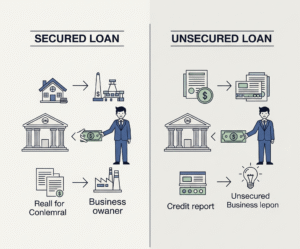

Collateral-Free Options

Businesses are not required to pledge any assets in order to receive collateral-free SME finance loans, such as those provided by the CGTMSE program. This is especially helpful for new businesses and small businesses with few assets.

Support for Growth

By providing access to capital, SME finance loans empower businesses to invest in growth opportunities, such as hiring new employees, launching marketing campaigns, or expanding product lines.

SME Loans in Hyderabad

Hyderabad, a thriving hub for startups and SMEs in India, has a robust ecosystem for SME loans in Hyderabad. The city’s dynamic business environment, coupled with its growing IT and manufacturing sectors, makes it a hotspot for SME financing. Several banks, Non-Banking Financial Companies (NBFCs), and SME finance companies in Hyderabad offer tailored loan products to support local businesses.

Why Hyderabad is a Key Market for SME Loans

A variety of sectors, including IT, manufacturing, retail, and pharmaceuticals, drive Hyderabad’s economy. SMEs in these sectors often require financing to scale operations or adopt new technologies. Additionally, government initiatives and a supportive startup ecosystem make Hyderabad an ideal location for accessing SME finance loans.

Top SME Finance Companies in Hyderabad

Several reputable lenders offer SME loans in Hyderabad, including:

SME loans from the State Bank of India (SBI) come with government-backed programs and competitive interest rates. HDFC Bank: Provides customized SME finance loans with quick disbursal and flexible terms.

Bajaj Finance is a NBFC known for its digital application process and collateral-free SME loans. Lendingkart: A fintech platform offering quick and hassle-free SME finance loans.

Tata Capital: Provides a range of SME loans with tailored solutions for businesses in Hyderabad.

How to Apply for an SME Loan in Hyderabad

In Hyderabad, applying for a small business loan is simple. The majority of lenders accept applications online, requiring businesses to submit basic documents like: Business registration certificate

GST returns

Bank statements

KYC documents of the business owner

Statements of finances or tax returns Once the documents are verified, lenders typically disburse the loan within a few days, depending on the loan amount and complexity.

Challenges in Securing SME Loans in Hyderabad

While Hyderabad offers ample opportunities for SME financing, businesses may face challenges such as:

High Interest Rates: Some NBFCs charge higher rates compared to banks, increasing the cost of borrowing.

Documentation: Stringent documentation requirements can be time-consuming for small businesses.

Credit Score: A low credit score can limit access to favorable loan terms.

By providing individualized solutions and expert guidance, working with a reputable SME finance company can assist in overcoming these obstacles.

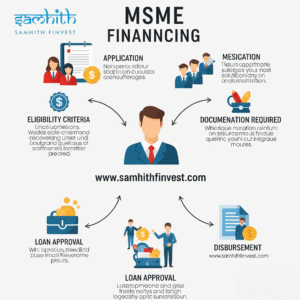

Eligibility Criteria for SME Finance Loans

To qualify for an SME finance loan, businesses must meet certain eligibility criteria, which vary by lender. Common requirements include:

Business Vintage: The business should typically be operational for at least 1-3 years.

Turnover: Lenders may require a minimum annual turnover, which typically ranges from ten thousand to one hundred thousand euros. Credit Score: A good credit score (typically 700 or above) improves the chances of loan approval.

Business Plan: A comprehensive business plan outlining how the loan will be used may be required by some lenders.

Documents Required

If you want to get a loan for SME finance, the documentation process is very important. Common documents include:

Documents for registering a business, such as a Partnership Deed or Certificate of Incorporation GST registration and returns

Expense reports from the last six to twelve months Returns from the last two to three years of income tax KYC documents (Aadhaar, PAN, etc.) of the business owner

Role of SME Finance Companies

In order to connect small businesses with readily available financing, small business finance companies play a crucial role. These businesses, in contrast to conventional banks, frequently concentrate on SME loans and supply innovative loan products, flexible terms, and quicker approval times. Some key advantages of working with an SME finance company include:

Speed: Faster loan processing and disbursal compared to banks.

Flexibility: Customized loan products tailored to specific industries or business needs.

Technology-Driven: Many SME finance companies leverage fintech platforms for seamless applications and approvals.

How SME Finance Companies Differ from Banks

SME finance companies have distinct advantages over banks, which provide SME finance loans: Less Stringent Criteria: SME finance companies may have more lenient eligibility requirements, making it easier for startups to qualify.

Collateral-Free Loans: Many SME finance companies offer unsecured loans, reducing the need for collateral.

Expertise in a Specific Field These businesses recognize the particular requirements of small and medium-sized enterprises (SMEs) and provide individualized solutions.

Tips for Choosing the Right SME Finance Loan

Careful consideration is required when selecting the appropriate SME finance loan. Here are some tips to guide your decision:

Assess Your Needs

Determine the purpose of the loan—whether it’s for working capital, expansion, or equipment purchase—and choose a loan type that aligns with your goals.

Compare Interest Rates

The cost of borrowing money can be significantly affected by interest rates. Find the most cost-effective option by comparing rates from a variety of lenders, including banks and SME finance companies.

Check Repayment Terms

Choose a loan with terms for repayment that work for your cash flow. Financial stress can be reduced through flexible repayment plans.

Evaluate Lender Reputation

Choose a lender with a strong track record of supporting SMEs. Read reviews and seek recommendations to ensure reliability.

Consider Government Schemes

Explore government-backed schemes like Mudra or CGTMSE, which offer collateral-free loans at competitive rates.

Case Study: Success with SME Finance Loans in Hyderabad

Let’s consider a hypothetical example of a small manufacturing business in Hyderabad. The company, specializing in eco-friendly packaging, needed ₹50 lakh to purchase new machinery and hire additional staff. The company was able to obtain a loan without collateral and with a repayment term of three years by applying for an SME loan in Hyderabad through a reputable SME finance company. The quick disbursal allowed the company to scale production, resulting in a 30% increase in revenue within a year. This case shows how SME finance loans can help small businesses grow and innovate.

Common Mistakes to Avoid When Applying for SME Finance Loans

Despite the substantial advantages of SME finance loans, businesses must avoid the following common pitfalls: Overborrowing: Taking a loan larger than needed can strain finances.

Ignoring Terms: Failing to read the fine print can lead to hidden fees or unfavorable terms.

Poor Financial Planning: Without a clear repayment plan, businesses may struggle to meet loan obligations.

Future of SME Finance Loans

The landscape of SME financing is evolving rapidly, driven by technology and government support. Fintech platforms are making it easier for businesses to access SME finance loans through digital applications and AI-driven credit assessments. In addition, the Atmanirbhar Bharat package and other government initiatives in India are helping to increase SME financing by providing loans without collateral and subsidies.

Role of Technology in SME Financing

Technology is transforming the way SMEs access finance. Online platforms like Lendingkart and Indifi provide instant loan approvals by analyzing digital data, such as GST returns and bank statements. This reduces paperwork and speeds up the lending process, making SME finance loans more accessible than ever.

Conclusion For small and medium-sized businesses looking to expand and succeed in a competitive market, an SME finance loan is an effective tool. Whether you’re a startup in Hyderabad or an established business elsewhere, understanding the SME meaning, the full form of SME, and the role of SME finance companies can help you make informed financing decisions. By choosing the right loan product and lender, SMEs can unlock their potential, drive innovation, and contribute to economic growth. If you’re in Hyderabad, look into the many options for SME loans there to help your business succeed.

Post Comment