Unsecured MSME Loan for New Business: Your Ultimate Guide to Growth Without Collateral

unsecured MSME loan for new business: It’s exciting to start a new business, but there are a lot of challenges, especially when it comes to getting funding. Due to their lack of collateral or a solid credit history, many entrepreneurs struggle to obtain loans. An unsecured MSME loan for new businesses can change the game in this situation.

We’ll go over everything you need to know about unsecured MSME loans in this comprehensive guide. From what they are, why they matter, to how you can get one—let’s explore how you can fuel your business growth without risking your assets.

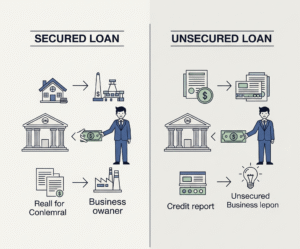

What is an Unsecured MSME Loan?

An unsecured micro, small, and medium-sized enterprise loan is a form of financing in which you are not required to pledge any asset or collateral. The term “Micro, Small, and Medium Enterprises” (MSME) refers to the businesses that make up the majority of economies. Unsecured loans give new businesses the capital they need without putting their personal or business assets in jeopardy.

These loans, in contrast to secured loans, heavily rely on your business plan, creditworthiness, and ability to repay. It’s a trust-based loan model that helps entrepreneurs, especially small and medium-sized businesses (MSMEs).

Why Choose an Unsecured Loan for Your New Business?

Starting a business requires managing a number of expenses, including inventory, salaries, equipment, marketing, and more. You might not have enough assets to pledge as collateral or you might prefer not to put your property up for collateral. Here’s why unsecured MSME loans are attractive:

- No collateral required: You don’t risk losing your assets.

- Quick processing: Less paperwork means faster approvals.

- Flexible usage: Use funds for working capital, expansion, or operational costs.

- Boost credit history: Timely repayments help build your credit profile.

Benefits of Unsecured MSME Loans

Fast Access to Funds

Since there’s no collateral evaluation, lenders process your application quickly. You can get money in your account within days—perfect for urgent business needs.

Minimal Documentation

No asset verification means fewer documents. This reduces hassle, especially for startups still organizing their paperwork.

Preserve Ownership and Assets

Your personal or business assets remain untouched. This is ideal if you want to keep full control without pledging property.

Build Business Credit

Successfully managing an unsecured loan can help establish a solid credit score, opening doors to more financing in the future.

Types of Unsecured MSME Loans Available

Working Capital Loans

Designed to cover day-to-day expenses like rent, utilities, and salaries without collateral.

Business Term Loans

Medium to long-term loans for equipment purchase, office setup, or business expansion.

Invoice Financing

Advance against unpaid invoices to maintain cash flow.

Line of Credit

Flexible borrowing up to a certain limit to manage cash flow fluctuations.

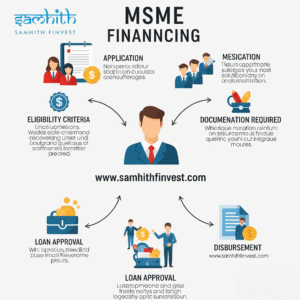

Eligibility Criteria for Unsecured MSME Loan for New Business

Business Registration

Your business must be registered under MSME guidelines with proper documentation.

Business Vintage

Typically, lenders prefer businesses operating for at least 6 months to 1 year. Some lenders may offer loans to startups with a solid business plan.

Credit Score

A decent credit score (usually 650+) improves your chances.

Annual Turnover

Many lenders require a minimum turnover threshold, which varies.

Age of Applicant

Usually between 21 to 60 years.

How to Apply for an Unsecured MSME Loan

Step 1: Research Lenders

Banks, NBFCs, fintech firms, and government schemes all offer unsecured loans. Compare interest rates, terms, and eligibility.

Step 2: Prepare Documents

Get your business registration, financial statements, bank statements, identity, and address proofs ready.

Step 3: Fill Application

Apply online or offline as per lender’s process.

Step 4: Loan Assessment

Lenders evaluate your creditworthiness and business viability.

Step 5: Loan Disbursal

Upon approval, funds are transferred to your account quickly.

Documents Required for Unsecured MSME Loans

-

Business registration certificate (Udyam Registration, GST, etc.)

-

PAN card and Aadhaar card of business owner

-

Bank statements (last 6 months)

-

Income tax returns

-

Financial statements (Profit & Loss, Balance Sheet)

-

Business plan (for startups)

Interest Rates and Repayment Terms

Unsecured loans usually come with slightly higher interest rates than secured loans. Depending on the lender and your profile, anticipate rates between 12 and 24 percent. Flexible repayment terms are available, ranging from 12 to 60 months, depending on your cash flow.

Low Interest Unsecured MSME Loan for New Business: How to Find It

Improve Credit Score

Timely payments and clearing existing dues improve creditworthiness.

Opt for Government-Backed Loans

Schemes like CGTMSE offer credit guarantees, reducing lender risk and interest rates.

Negotiate with Multiple Lenders

Compare offers and negotiate terms for better rates.

Maintain Transparent Financial Records

Clean books assure lenders of your repayment capacity.

Unsecured MSME Loan in Hyderabad: Regional Insights

Hyderabad is a booming startup hub with many MSMEs thriving in tech, manufacturing, and services. In Hyderabad, customized unsecured MSME loan products with startup-friendly policies are offered by local banks and NBFCs. In addition, Hyderabad’s expanding entrepreneurial ecosystem means easier access to loan advisory services and improved networking opportunities.

Common Challenges and How to Overcome Them

Higher Interest Rates: Mitigate by opting for government-backed schemes.

Loan Rejection: Improve documentation and credit scores.

Shorter Tenures: Plan cash flows realistically and negotiate flexible terms.

Limited Lender Options: Explore NBFCs and fintech companies beyond traditional banks.

Tips to Improve Your Chances of Loan Approval

Maintain a good personal and business credit score.

Keep all business licenses and registrations updated.

Prepare a strong business plan highlighting revenue models and projections.

Build a positive relationship with your bank.

Avoid multiple loan applications simultaneously.

The chance to obtain financial support without putting your valuable assets in jeopardy is presented by an unsecured MSME loan for new businesses. Although it may have higher interest rates than secured loans, the convenience, speed, and ease of access make it an excellent option for small businesses and startups. You can get the best loan for your business needs if you know your eligibility, prepare the right paperwork, and choose the right lender.

Keep in mind that the thriving business community in Hyderabad also provides numerous opportunities and assistance to MSMEs seeking unsecured loans. Therefore, an unsecured MSME loan could be your ticket to success, whether you are just starting out or expanding.

Post Comment