Unsecured Business Loans: Fueling Growth Without Collateral

Unsecured business loans have emerged as a game-changing financial tool for entrepreneurs, startups, and MSMEs in today’s fast-paced business environment. Without the need for collateral, these loans give businesses the much-needed working capital they need. This makes them a good choice for businesses that may not yet own assets or want to keep their property risk-free.

This guide will teach you everything you need to know about unsecured business loans, including what they are, how they work, who is eligible for them, what their benefits are, and how to choose the right one for your business.

What Are Unsecured Business Loans?

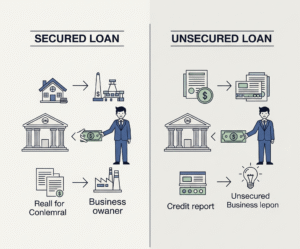

Loans for businesses that don’t require collateral are known as unsecured business loans. Unsecured loans, in contrast to secured loans, rely heavily on the borrower’s creditworthiness, business performance, and financial history. In a secured loan, assets like property, equipment, or vehicles are pledged as security.

These loans are especially helpful for entrepreneurs, small businesses, and startups who may not have a lot of assets because they don’t require collateral. Additionally, the processing time for these loans is typically faster.

Why Choose Unsecured Business Loans?

Time management and adaptability are crucial when running a business. Unsecured loans are frequently the choice of business owners for the following reasons:

No collateral required – Keep your personal and business assets safe.

Quick approval – Faster disbursement helps tackle urgent financial needs.

Flexible usage – Use the funds for working capital, hiring, marketing, or expansion.

Ideal for startups and MSMEs – Especially beneficial for businesses in the early stages of growth.

Benefits of Unsecured Business Loans for MSMEs

1. Easy Accessibility

Unsecured business loans for MSMEs are widely available through banks, NBFCs, and digital lenders. These institutions focus more on cash flow, turnover, and credit history rather than assets, making loans more accessible to small business owners.

2. Fast Approval and Disbursement

Most lenders offer quick approval processes—sometimes within 24 to 48 hours. MSMEs often need funds at short notice, and unsecured loans serve this purpose well.

3. No Risk to Personal or Business Assets

With no asset required as a guarantee, business owners can secure funding without the fear of losing valuable possessions in case of default.

4. Ideal for Short-Term Needs

Whether it’s buying inventory, hiring seasonal staff, or covering operational expenses, unsecured loans are perfect for short-term financial requirements.

Who Can Apply? Unsecured Business Loan Eligibility

Before approving unsecured business loans, lenders typically look at a few key factors. These include:

Business vintage – Most lenders prefer businesses operating for at least 1-2 years.

Annual turnover – A steady revenue stream builds credibility.

Credit score – A score above 650 is often expected.

Applicant’s age – Typically between 21 to 65 years.

Banking and financial records – Strong financial history supports approval.

Startup-Friendly

Many lenders now offer unsecured business loans for startups, with slightly different criteria. While a credit score is still important, they may also evaluate investor backing, projected revenues, or business models.

Types of Unsecured Business Loans

Understanding the various types of unsecured loans can help you choose the right fit:

1. Term Loans

Borrow a fixed amount and repay it in EMIs over a set period. These are great for funding growth plans or capital expenditure.

2. Line of Credit

Draw funds as needed up to a limit, and pay interest only on the amount utilized. Perfect for businesses with fluctuating cash flow.

3. Working Capital Loans

These loans help meet daily operational costs like payroll, rent, and inventory.

4. Merchant Cash Advances

Receive an upfront amount and repay it through a percentage of daily card sales—ideal for retail and e-commerce businesses.

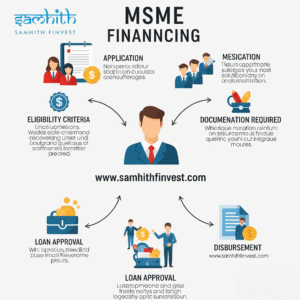

How to Apply for an Unsecured Business Loan

The process of applying for an unsecured business loan has become more user-friendly and streamlined. A general overview is as follows:

Step-by-Step Process

Check Eligibility – Ensure your business meets the lender’s criteria.

Compare Offers – Look at interest rates, tenure, and lender reputation.

Prepare Documents – Commonly required documents include:

Business registration proof

Bank statements (last 6–12 months)

ITR and financial statements

KYC of the applicant

Apply Online or Offline – Fill in the application form and submit documents.

Loan Approval & Disbursal – Once approved, funds are transferred to your account.

Unsecured Business Loan Interest Rates: What to Expect

Due to the increased risk for lenders, unsecured loans typically have higher interest rates than secured ones. Nevertheless, rates can vary depending on the following:

| Criteria | Impact on Interest Rates |

|---|---|

| Business Vintage | Older businesses often get better rates |

| Credit Score | Higher scores = lower interest |

| Annual Revenue | Strong turnover improves bargaining power |

| Loan Tenure | Shorter terms might attract higher rates |

| Lender Type | NBFCs and fintechs might offer better deals |

Average Interest Rates

Banks: 10% – 22% p.a.

NBFCs/Fintechs: 12% – 28% p.a.

Tip: Always negotiate! Even a 1% reduction in the interest rate can save you a lot over time.

Key Considerations Before Taking an Unsecured Business Loan

Before applying, ask yourself the following:

1. Do You Really Need It?

Avoid borrowing unless absolutely necessary. Consider if the loan will generate enough ROI.

2. Can You Afford the EMI?

Evaluate your monthly cash flows to ensure you can repay without stress.

3. Have You Explored All Options?

Sometimes a government-backed MSME scheme or subsidy might offer better terms.

4. Are You Aware of All Charges?

Check for hidden costs like:

Processing fee

Prepayment penalty

Late payment charges

Digital Lenders: A New Age Solution

Fintech companies have revolutionized the way unsecured loans are disbursed. Platforms are making it simpler for businesses to borrow money by requiring minimal documentation, granting loans immediately, and utilizing digital verification.

Benefits of Digital Lending Platforms

Paperless process

Faster approvals

Pre-approved offers

Automated KYC and credit checks

How to Improve Your Chances of Loan Approval

If you’re worried about approval, here are some strategies to boost your chances:

1. Maintain Clean Financial Records

Timely filing of taxes, clean ITRs, and proper bookkeeping go a long way.

2. Build Your Credit Score

Pay bills and EMIs on time. Reduce your credit utilization ratio.

3. Apply with the Right Lender

Each lender has its own criteria. Match your profile to the most suitable one.

4. Show Consistent Revenue

Consistent monthly revenue gives lenders confidence in your ability to repay.

When to Avoid an Unsecured Business Loan

Unsecured loans may not be the best option for everyone, despite their benefits:

If the interest rate is too high to make repayments feasible.

If you can qualify for a lower-cost secured loan or government scheme.

If your cash flow is unpredictable, leading to EMI defaults.

Always consider the cost-benefit analysis before borrowing.

Alternatives to Unsecured Business Loans

If you decide an unsecured loan isn’t the right fit, consider these alternatives:

Business Credit Cards – Useful for small and frequent expenses.

Equity Financing – If you’re willing to dilute ownership.

Invoice Financing – Turn unpaid invoices into working capital.

Crowdfunding – Raise funds through public contributions.

Is an Unsecured Business Loan Right for You?

Unsecured business loans offer a powerful and flexible solution to bridge funding gaps—especially for startups, small businesses, and MSMEs with limited assets. With fast disbursals, no collateral requirements, and flexible usage, they’re often the go-to option for modern entrepreneurs.

However, like any financial product, they come with responsibilities. You must assess unsecured business loan eligibility, compare unsecured business loan interest rates, and ensure you’re borrowing within your repayment capacity.

Whether you’re expanding your inventory, hiring talent, or simply stabilizing your cash flow—an unsecured business loan could be the catalyst your business needs.

Post Comment