Fuel Your Business Growth with an Unsecured Business Loan Without Collateral

unsecured business loan without collateral: In today’s dynamic economic environment, businesses—especially small and medium enterprises (SMEs)—require fast and flexible financing options. However, not all entrepreneurs have valuable assets to pledge. That’s where an unsecured business loan without collateral becomes essential.

This will help you understand everything about getting an unsecured business loan without collateral, how it works, eligibility, and tips to maximize your chances of approval.

What is an Unsecured Business Loan Without Collateral?

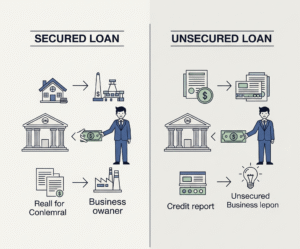

An option for funding that does not require assets or security is known as an unsecured business loan. Unlike traditional secured loans that require collateral like property or inventory, unsecured loans are granted based on the borrower’s creditworthiness and business profile.

Whether you’re a startup, an SME, or an established business expanding operations, an unsecured business loan for small business can provide the needed financial boost without risking your assets.

Benefits of Unsecured Business Loans

No Collateral Required

The fact that you do not need to mortgage your home, property, or any other valuable asset is probably the most significant advantage.

Quick Processing and Disbursal

These loans are often processed faster since there’s no asset verification process involved.

Flexibility in Usage

Funds can be used for working capital, marketing, buying equipment, hiring staff, or any business expansion plans.

Ideal for Small Businesses and Startups

Especially suited for those who don’t have significant assets but have a strong business plan or stable cash flow

Who Can Apply for an Unsecured Business Loan?

Eligible Business Types

Proprietorships

Partnerships

Private Limited Companies

LLPs

Startups and SMEs

Basic Eligibility Criteria

Age: 21–65 years

Business operation: At least 1 year (varies by lender)

Annual turnover: Minimum ₹10 lakhs (some may accept less)

Indian citizenship

Types of Unsecured Business Loans

Working Capital Loans

These help businesses manage day-to-day operations like salaries, rent, and inventory.

Term Loans

Fixed-term loans with monthly EMIs—used for expansion or asset acquisition.

Line of Credit

A pre-approved credit limit that businesses can tap into as needed.

Merchant Cash Advance

Lenders provide funds based on future credit card/debit card sales.

How to Qualify for an Unsecured Loan Without Collateral

Strong Credit Score

A CIBIL score of 700 or higher is your goal. Some fintech lenders may approve lower scores for strong business profiles.

Healthy Cash Flow

Demonstrated ability to repay through consistent income helps in getting better terms.

Clean Banking History

Avoid frequent overdrafts, cheque bounces, or negative balances.

Interest Rates on Unsecured SME Loan with Low Interest

Unsecured loans usually carry higher interest rates due to higher risk for the lender. However, it’s still possible to get an unsecured SME loan with low interest if you meet the following:

Factors That Affect Interest Rates

Business turnover

Credit score

Loan tenure

Relationship with lender

Industry profile

Average Interest Rates

NBFCs: 15% – 24% p.a.

Banks: 12% – 20% p.a.

Online lenders: 16% – 30% p.a.

Documents Required

Here are common documents needed for unsecured business loan applications:

PAN card (individual and business)

Aadhaar card

Business address proof

Bank statements (last 6–12 months)

ITRs for the last 1–2 years

Business registration proof

GST returns

How to Get an Unsecured Business Loan with Bad Credit

Some fintech and NBFC lenders offer unsecured business loans with bad credit, despite the fact that the majority of lenders prefer good credit.

Tips to Get Approved with Poor Credit

Offer a co-applicant with good credit

Provide strong income statements

Apply through NBFCs or digital lenders

Seek smaller amounts initially

Mistakes to Avoid When Applying

Applying with Multiple Lenders at Once

Each application creates a hard inquiry on your credit report, lowering your score.

Ignoring the Fine Print

Review terms like prepayment charges, processing fees, and late penalties.

Falsifying Documents

This leads to immediate rejection and blacklisting.

Tips to Improve Loan Eligibility

Maintain a healthy credit score

File regular ITRs

Keep financial records updated

Build good relationships with banks

Avoid bounced cheques

An unsecured business loan without collateral can empower small businesses and startups by offering hassle-free access to funding. Whether you’re seeking an unsecured business loan for small business expansion, a low-interest unsecured SME loan, or facing hurdles due to a bad credit history, there’s a financing solution for your needs.

Explore your options, maintain good financial discipline, and choose the right lender to turn your business vision into reality.

Post Comment