Understanding the Role of an SME Bank in India

Introduction to SME Banking

India’s small and medium enterprises (SMEs) are the backbone of the economy, contributing significantly to GDP, exports, and employment. As these enterprises continue to scale, they require tailored financial solutions to manage their growth effectively. This is where a specialized SME Bank plays a crucial role.

What is an SME Bank?

An SME Bank is a financial institution that offers dedicated banking services to small and medium enterprises. These banks focus on providing financial products and services such as loans, working capital, cash management, and advisory tailored specifically for SMEs.

Objectives of

Address the financial challenges faced by SMEs.

Offer custom loan products and business finance.

Bridge the sme finance gap in the market.

Importance of SME Banking in India

India’s economic growth is closely linked to the performance of its SMEs. By availing the services of an , businesses get access to a host of financial solutions critical to their operations.

Key Contributions

Financing new ventures and innovation

Supporting rural and urban employment

Enhancing global trade competitiveness

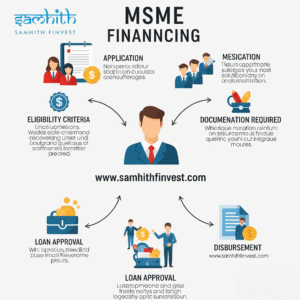

Types of Services Offered by

Business Loans and Working Capital

SMEs need consistent working capital to operate efficiently. provide:

Term loans

Cash credit

Overdraft facilities

Apply For MSME Loan

Businesses looking to Apply For MSME Loan can do so easily through online or branch channels of . These loans typically feature:

Flexible repayment schedules

Minimal documentation

Trade and Foreign Exchange Services

SMEs involved in international trade can benefit from forex services, including:

Export credit

Import financing

Currency hedging

Advantages of Choosing an SME Bank

Tailored Financial Products

SME Banks understand the unique needs of small businesses and customize their offerings accordingly.

Expert Advisory Services

Financial planning, investment advice, and regulatory assistance are often provided by dedicated SME relationship managers.

Digital Banking for SMEs

Most modern offer digital portals for quick access to services like:

Account management

Loan tracking

Online loan applications

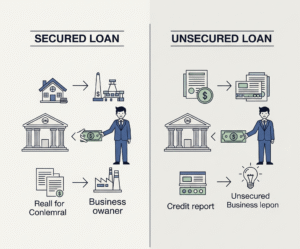

Understanding the Loan Process

Eligibility Criteria

The criteria vary based on the type of loan, but typically include:

Valid business registration

Minimum turnover requirements

Good credit history

Documents Required

To Apply For MSME Loan, businesses usually need:

Business PAN and address proof

Financial statements

GST returns and bank statements

SME Loan in Ameerpet: A Case Study

Ameerpet, a bustling business district in Hyderabad, is witnessing a surge in SME growth. Local entrepreneurs in Ameerpet are leveraging the benefits of SME Loan in Ameerpet to expand their ventures.

Financial Institutions Supporting SMEs in Ameerpet

Public sector banks

Private SME Banks

NBFCs (Non-Banking Financial Companies)

Government Schemes and Incentives

Credit Guarantee Fund Scheme (CGTMSE)

Provides collateral-free credit for MSMEs through SME Banks.

MUDRA Loans

Offered under Pradhan Mantri Mudra Yojana (PMMY), these loans cater to micro-enterprises.

SIDBI Assistance

The Small Industries Development Bank of India (SIDBI) offers direct and indirect lending to SMEs.

Business Finance for SMEs: Challenges and Solutions

Common Challenges

Limited access to credit

Inadequate collateral

High-interest rates

Solutions by SME Banks

Collateral-free loans

Lower interest rates for priority sectors

Flexible tenure options

Digital Transformation of SME Banking

AI and Data Analytics

SME Banks are using AI tools to analyze creditworthiness and customize loan offers.

Mobile and Internet Banking

Easy access to banking services through dedicated SME mobile apps.

Choosing the Right SME Bank

Factors to Consider

Reputation and credibility

Range of financial products

Digital capabilities

Top SME Banks in India

State Bank of India (SBI)

HDFC Bank

ICICI Bank

Kotak Mahindra Bank

The Future of SME Banking

The sector is evolving with fintech collaborations, AI-driven insights, and real-time customer support. The growing demand for Business Finance for SMEs ensures a promising future for this niche.

Conclusion

The contribution of SMEs to the Indian economy cannot be overstated, and a dedicated SME Bank plays a vital role in supporting this ecosystem. Whether it’s to Apply For MSME Loan, explore Business Finance for SMEs, or secure an SME Loan in Ameerpet, choosing the right bank can be a game changer for businesses looking to scale and innovate.

Post Comment