Secured SME Loans for New Businesses

Secured SME Loans for New Businesses

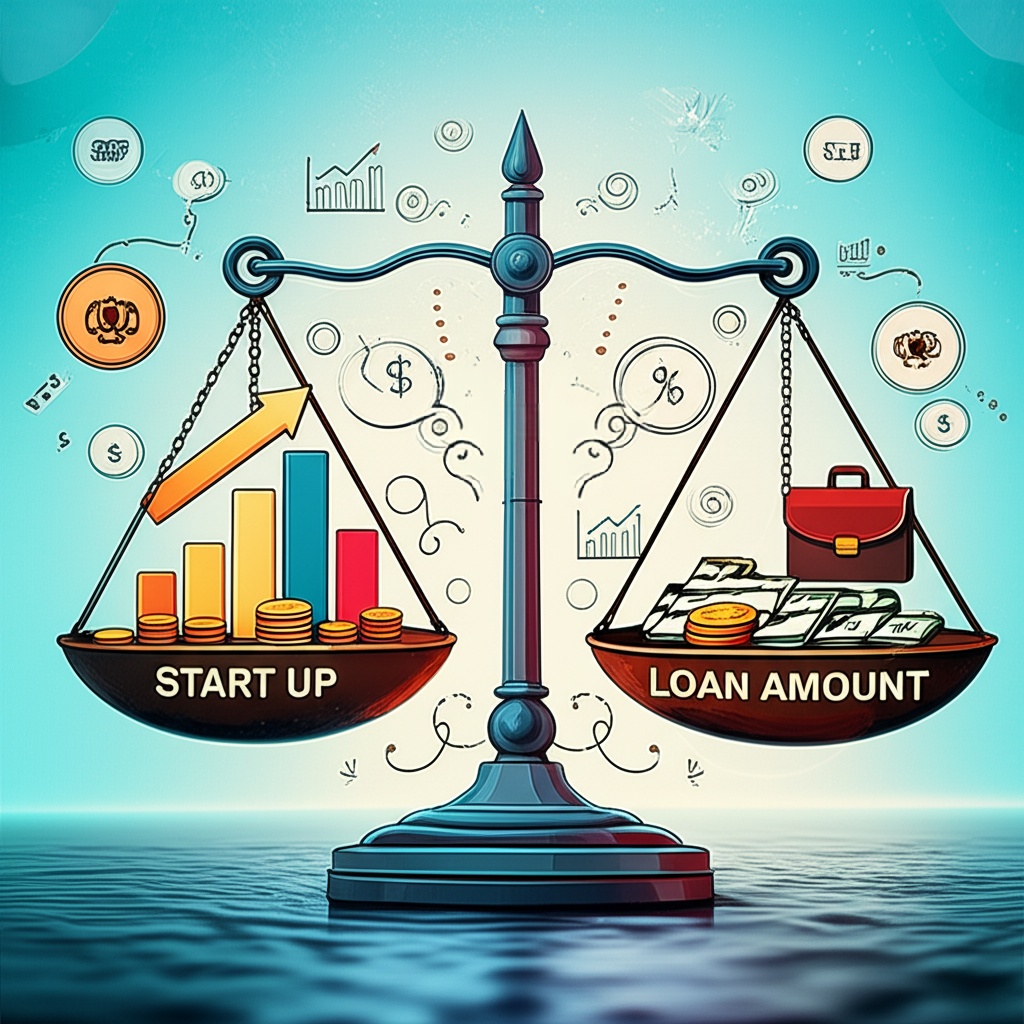

It can be both exciting and overwhelming to start a new business. Securing the necessary funding is one of the most important aspects of starting a successful business. For many entrepreneurs, especially those launching small and medium-sized enterprises (SMEs), obtaining financing can be a significant hurdle. Secured business loans come into play in this situation. They provide an effective way for startups to access the capital they need while leveraging their assets as collateral.

In this comprehensive guide, we will explore everything you need to know about Secured SME loans for new businesses, including their benefits, how to qualify, and the best options available.

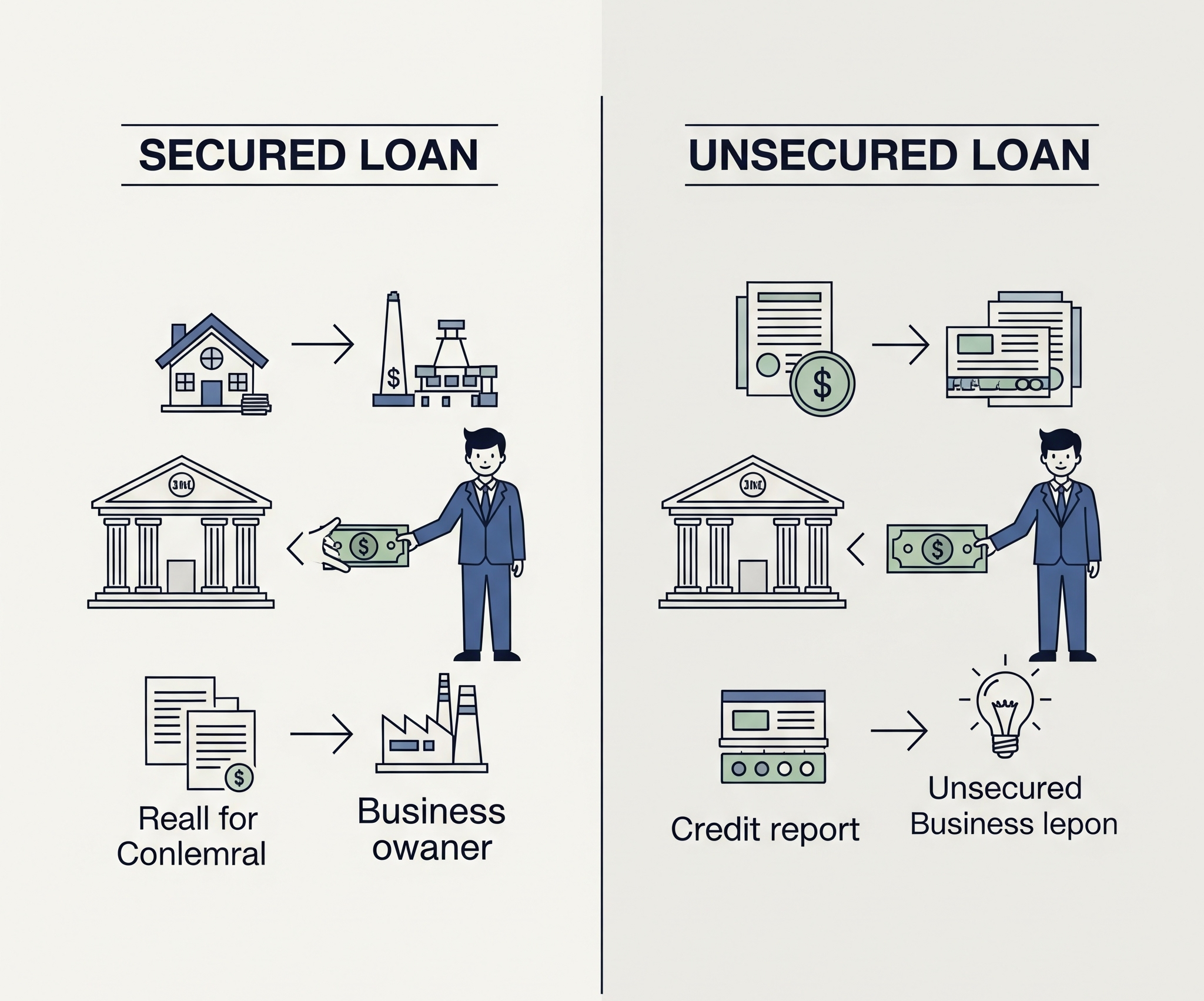

What Are Secured Business Loans?

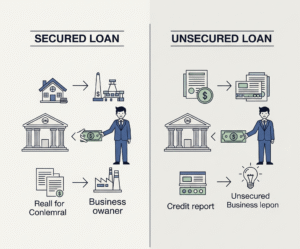

Secured business loans are loans backed by collateral. This means that the borrower pledges assets (such as real estate, equipment, or inventory) to the lender as security for the loan. The lender has the right to seize the borrower’s assets to cover their losses if the borrower defaults on the loan.

Why Choose Secured Business Loans?

Startups and small businesses prefer secured loans for the following reasons:

Lower interest rates

Higher borrowing limits

Longer repayment terms

Better odds of getting approved, even if you have bad credit

These loans are particularly helpful for new businesses that may not yet have a strong credit history or stable cash flow.

Advantages of Secured Small Business Loans for New Businesses

Access to Larger Loan Amounts

Lenders are more receptive to offering larger loan amounts when secured business loans are backed by collateral. This can be a significant advantage for startups that require substantial capital for equipment, inventory, or marketing.

Lower Interest Rates

Due to the collateral’s ability to reduce the lender’s risk, secured business loans with low interest rates are more readily available. Because of this, new businesses can get financing at a price they can afford.

Flexible Repayment Terms

These loans typically have longer repayment terms, which can help the company grow steadily and alleviate cash flow pressures.

Easier Approval for Bad Credit Borrowers

Even if you have a poor credit history, you may still qualify for secured business loans with bad credit by offering valuable collateral. This opens up funding opportunities that would otherwise be unavailable.

How to Qualify for Secured Business Loans

To guarantee a loan, tangible assets are required by lenders. Common collateral types include:

Real estate

Equipment

Vehicles

Inventory

Accounts receivable

Prepare a Solid Business Plan

A comprehensive business plan demonstrates your market knowledge and growth strategy. It also reassures lenders that you have a clear strategy for repaying the loan.

Improve Your Credit Score

While secured loans are available to those with bad credit, improving your credit score can help you access better terms and interest rates.

Choose the Right Lender

Different lenders offer varying terms and eligibility requirements. Find the best secured business loans for new businesses by conducting thorough research.

Types of Secured Business Loans

Equipment Financing

Use the loan to purchase necessary equipment. The equipment itself serves as collateral.

Inventory Financing

ideal for businesses that require large inventory purchases. The inventory serves as security.

Real Estate Loans

Used to purchase commercial property. These loans are typically larger and have longer repayment periods.

Accounts Receivable Financing

Borrow against your accounts receivable. This helps with cash flow issues while waiting for customer payments.

Best Secured Business Loans for Startups

Traditional Bank Loans

Banks offer competitive rates and terms for secured loans. However, approval can be challenging for new businesses.

SBA Loans

Through approved lenders, the Small Business Administration offers loans that are partially guaranteed. These are a great option for startups.

Online Lenders

Online lending platforms provide fast and flexible funding. Many cater exclusively to small businesses and startups.

Credit Unions

Compared to traditional banks, credit unions frequently provide better rates and more individualized service.

Common Challenges and How to Overcome Them

Valuation of Collateral

Ensure your assets are accurately valued and well-documented. This can help in securing a higher loan amount.

Legal and Documentation Requirements

Prepare all necessary paperwork, including property deeds, equipment receipts, and financial statements.

Risk of Asset Loss

Understand the risks involved. Defaulting on the loan means losing the collateral, so borrow responsibly.

Secured Business Loans with Bad Credit

You can still get secured funding even if you have poor credit. Lenders will focus more on the value of your collateral than your credit score. Here are some tips:

Offer high-value collateral

If you can, get a cosigner.

Provide evidence of contracts or revenue.

Clearly demonstrate a repayment strategy.

Steps to Apply for a Secured Business Loan

Step 1: Determine Your Needs

Calculate how much capital you need and what you will use it for.

Step 2: Identify Suitable Collateral

Estimate the value of the assets you can pledge and list them.

Step 3: Research Lenders

Compare offers from banks, online lenders, and credit unions.

Step 4: Prepare Your Documents

Include your financial statements, tax returns, and business plan as collateral.

Step 5: Submit Your Application

Apply to multiple lenders to increase your chances of approval.

Tips to Get the Best Secured Business Loans

Shop Around

Compare interest rates, fees, and repayment terms from different lenders.

Negotiate Terms

Don’t hesitate to negotiate for better terms, especially if you have strong collateral.

Read the Fine Print

Understand all terms and conditions, including what happens in case of default.

Seek Professional Advice

Consult a financial advisor or accountant to help you choose the right loan.

Post Comment