Secured Business Loans for Women Entrepreneur in India

Secured Business Loans for WomenEmpowering Women in Business

India has witnessed a significant rise in women-led businesses over the past decade. From small-scale startups to well-established enterprises, women entrepreneurs are leaving an indelible mark across various industries. However, access to finance remains a crucial factor in sustaining and scaling these businesses. One of the most reliable funding options available is Secured Business Loans for Women Entrepreneurs in India. These loans not only offer lower interest rates but also higher loan amounts and flexible repayment terms.

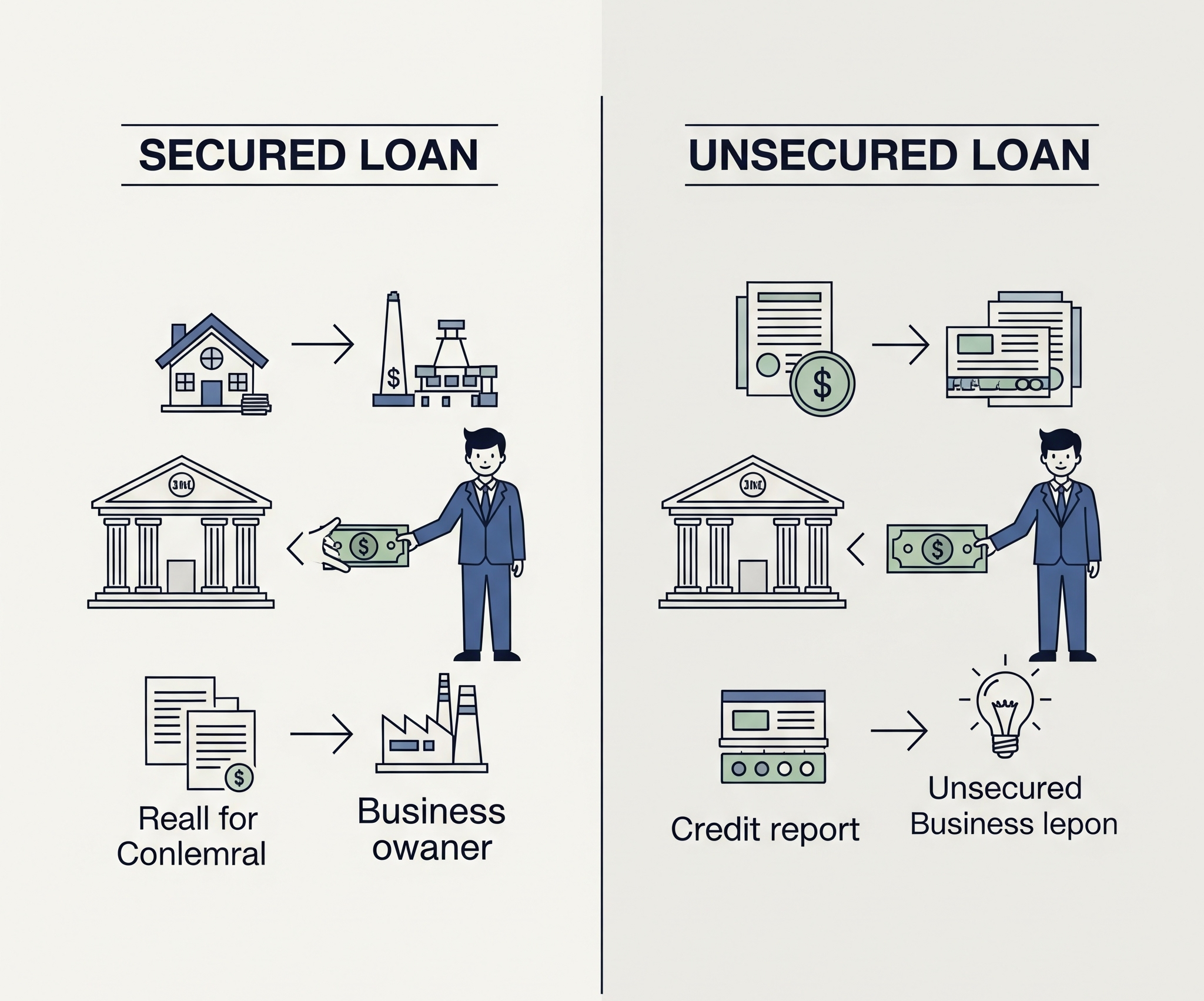

Understanding Secured Business Loans

The borrower must pledge an asset—such as property, machinery, or inventory—as collateral for secured business loans. This makes it easier for borrowers to obtain better loan terms and lowers the risk for the lender. This increases the likelihood of loan approval and improves financial leverage for female entrepreneurs.

Benefits of Secured Loans for Women Entrepreneurs

Lower Interest Rates: Due to reduced risk. Secured Business Loans for Women Higher Loan Amounts: Depending on the value of the collateral. A longer repayment tenure makes it easier to manage the monthly payments.

Flexible Use: Ideal for working capital, expansion, equipment purchase, etc.

Why Women Entrepreneurs in India Should Choose Secured Loans

Secured Business Loans for Women Women-led MSMEs now have access to exclusive secured loan programs from a number of public and private financial institutions. These schemes are often tailored to meet the unique challenges and growth potential of female business owners.

Access to Capital for Expansion

Women-owned MSMEs often struggle to scale due to capital constraints. Secured term loans for MSMEs allow entrepreneurs to invest in new projects, machinery, or branches without depleting operational cash flow.

Enhanced Business Credibility

Opting for secured loans builds a positive credit history, making it easier for future funding.

Government Schemes Supporting Women Entrepreneurs

Several government initiatives like Stand-Up India, Mudra Yojana (for Shishu, Kishore, and Tarun), and CGTMSE support women entrepreneurs in accessing secured and unsecured loans.

Best Secured Business Loan Providers for MSMEs

Choosing the right lender is crucial for getting the most favorable loan terms. The following are some of India’s best providers of secured business loans to MSMEs:

1. State Bank of India (SBI)

offers women-specific MSME loans.

Lower interest rates for secured options.

2. SIDBI (Small Industries Development Bank of India)

Specializes in funding MSMEs.

Offers exclusive schemes for women entrepreneurs.

3. HDFC Bank

Quick loan processing and flexible repayment.

Offers collateral-based loans with attractive terms.

4. ICICI Bank

Customizable business loan products.

High loan amounts for valuable collateral.

5. Bajaj Finserv

Fast approval and disbursal.

Suitable for financing equipment and working capital.

Secured Business Loans for Working Capital

Secured Business Loans for WomenWorking capital is the lifeblood of any business. For women entrepreneurs managing MSMEs, timely access to working capital can be a game-changer.

How Secured Loans Can Help

Purchase inventory in advance of peak seasons to stock up.

Payments to Vendors: Keep your relationships with suppliers strong.

Operational Expenses: Manage payroll, rent, and utilities smoothly.

Examples of Use Cases

The loan can be used to purchase holiday merchandise by a Delhi-based boutique owner. A female-led manufacturing unit in Pune can use it to buy raw materials in bulk.

Easy Approval for Secured Business Loans in Hyderabad

Hyderabad has emerged as a significant business hub, especially for women entrepreneurs in sectors like IT, retail, food, and fashion.

Why Hyderabad is a Hotspot

Numerous NBFCs and banks that are friendly to SMEs are present.

Government support through TS-iPASS, WE-Hub, and other initiatives.

How to Get Easy Approval

Maintain Correct Documentation: Prepare your project report, GST registration, income tax returns, and GST registration.

Valuation of Collateral: Ensure the asset is evaluated by a certified agency.

Credit History: Maintain a good credit score.

Top Lenders in Hyderabad

Andhra Bank

Bank of Baroda

Axis Bank

Kotak Mahindra Bank

Lendingkart

Steps to Apply for a Secured Business Loan

Understanding the application process can streamline your loan journey.

Step 1: Identify Your Loan Requirement

Know what you want the loan for—expansion, equipment, working capital, etc.

Step 2: Choose the Right Lender

Compare eligibility, processing costs, and interest rates.

Step 3: Prepare the Documents

Documents for KYC

Evidence of business registration

Statements of finances

Collateral documents

Step 4: Submit the Application

Depending on the lender, online or offline.

Step 5: Verification and Disbursal

The lender will evaluate your documents, verify your collateral, and approve the loan.

Tips to Increase Loan Approval Chances

Maintain Good Financial Records

Lenders are more likely to trust you if your finances are audited and kept up to date.

Choose Valuable Collateral

Property in urban areas or high-value machinery increases your loan eligibility.

Build Your Credit Profile

Repay existing loans on time to maintain a strong credit score.

Opt for Government-Backed Schemes

For female entrepreneurs, these provide better terms and speedier processing.

Challenges Faced by Women Entrepreneurs and How Loans Help

Common Challenges

Gender bias in funding

A lack of financial knowledge

Limited access to networks

How Secured Loans Can Bridge the Gap

Easier to get than unsecured loans with poor credit

Lower EMIs help manage business and personal finances

Create a platform for expanding businesses and creating jobs.

Post Comment