Secured Business Loans for Startups

Secured Business Loans for Startups: A Complete Guide

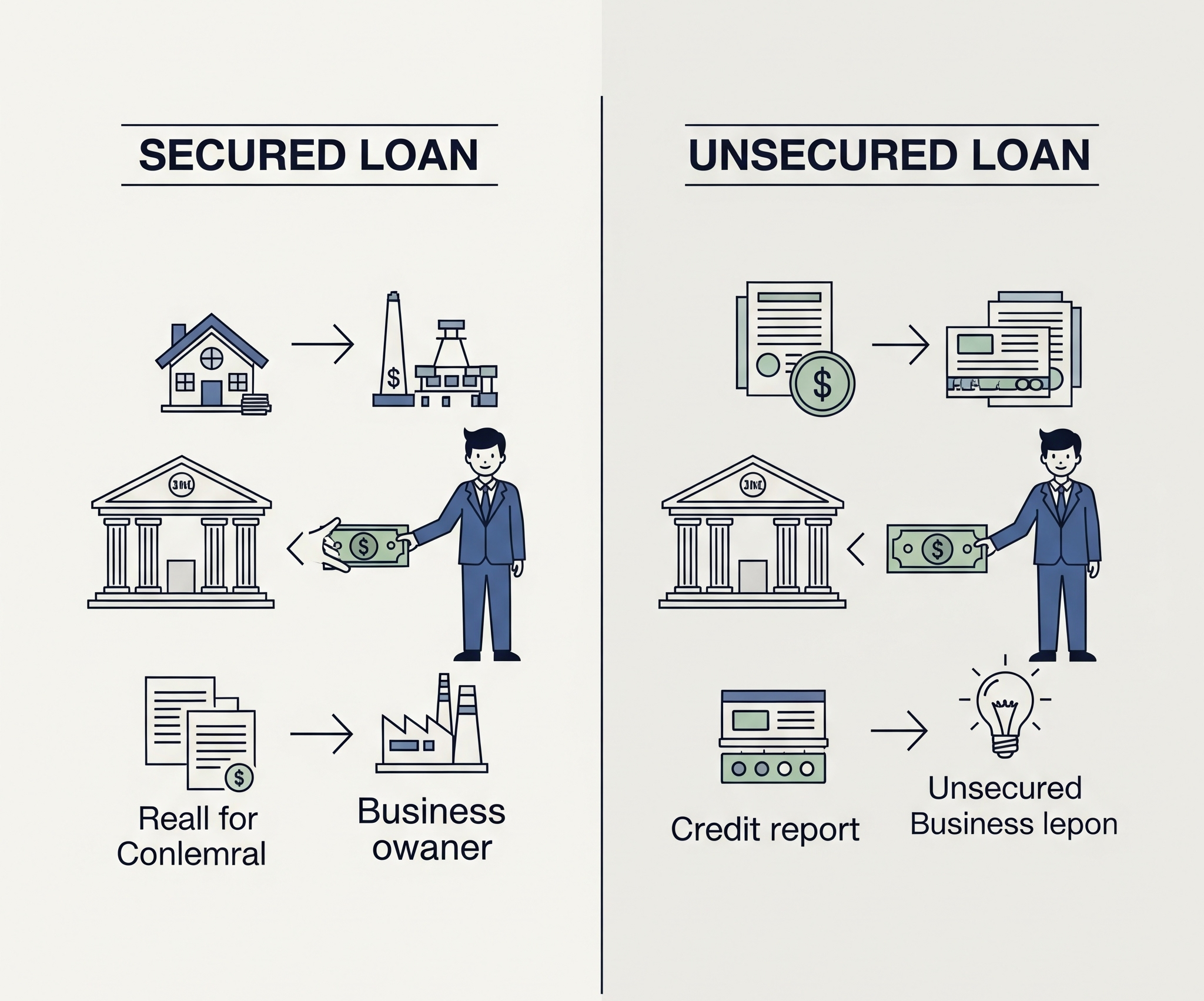

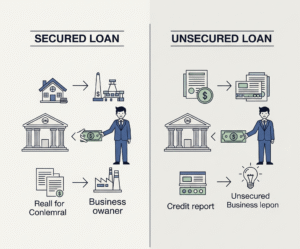

Introduction to Secured Business Loans

One type of funding that requires collateral are secured business loans. For startups, especially those with limited credit history, these loans can provide the capital needed to launch and grow. Because the asset backing the loan reduces the lender’s risk, these loans offer better repayment terms and lower interest rates than unsecured options.

The Benefits of Secured Business Loans for New Businesses

Starting a new business is risky, and funding can be a significant barrier. Here’s why secured business loans are often the best option:

Lower Interest Rates

Lenders are more comfortable offering low-interest secured business loans because they have collateral to fall back on. This makes repayments more manageable for startups.

Higher Loan Amounts

When compared to unsecured loans, you can typically borrow more money because lenders face less risk.

Flexible Repayment Terms

Secured loans generally come with flexible repayment options, which are beneficial for businesses in the early stages of revenue generation.

Types of Collateral for Secured Business Loans

Real Estate

Security can be provided by personal or business property. This is common for larger loan amounts.

Equipment and Machinery

These assets can be used as collateral by startups that spend a lot of money on equipment.

Inventory

Retail and manufacturing startups may use their inventory to secure funding.

Accounts Receivable

Some lenders accept invoices as collateral, which is ideal for businesses with steady income streams.

Best Secured Business Loans for Startups

Choosing the right lender and loan product is crucial. Some of the best secured business loans for new businesses are as follows:

Traditional Bank Loans

Banks offer competitive interest rates and repayment terms but may require substantial documentation and good credit scores.

SBA Loans (U.S. Specific)

A portion of the loan is guaranteed by the Small Business Administration, lowering the lender’s risk. These loans are perfect for startups with modest credit.

Online Lenders

Although interest rates may be slightly higher, many online platforms provide secured business loans quickly and with less paperwork.

Credit Unions

Often overlooked, credit unions offer community-based, personalized loan services with flexible terms.

How to Qualify for a Secured Business Loan

Prepare a Solid Business Plan

It is essential to demonstrate your startup’s potential. Financial projections, a market analysis, and a growth strategy should be part of your business plan.

Determine Your Collateral

Determine what assets you can offer as collateral for the loan. The more valuable and liquid, the better your loan terms will be.

Check Your Credit Score

Your personal and business credit scores are still important, even though they aren’t as important as with unsecured loans.

Gather Financial Documents

Lenders typically require bank statements, tax returns, and proof of collateral ownership.

Secured Business Loans With Bad Credit

Many startups struggle with credit. Thankfully, there are choices:

Asset-Based Lenders

Your collateral’s value is more important to these lenders than your credit history.

Microloans and Non-Profit Lenders

Organizations like Accion and Kiva offer small secured loans with lenient credit requirements.

Peer-to-Peer Lending

Some platforms connect borrowers with individual investors who may be more flexible on credit issues.

Benefits of Low-Interest Secured Business Loans

Cost Savings

Lower interest rates mean less money spent on financing, increasing your profitability.

Better Cash Flow Management

Predictable, lower payments allow startups to manage budgets more effectively.

Credit Building

Timely repayment of a secured business loan can improve your credit score, opening doors to more funding.

Risks and Considerations

Risk of Losing Collateral

Defaulting on a secured loan means you could lose your asset.

Valuation Challenges

Getting an accurate valuation of your collateral can be difficult and may affect loan terms.

Longer Approval Times

Due diligence on the collateral may delay loan approval compared to unsecured loans.

Secured SME Loans for New Businesses

Secured loans are especially beneficial to small and medium-sized businesses (SMEs):

Tailored Loan Products

Many financial institutions offer secured SME loans for new businesses with customized repayment options and support.

Government-Backed Programs

Look for local programs supporting new SMEs with secured funding solutions.

Growth Enablement

SMBs can use these loans to expand, hire staff, and invest in infrastructure.

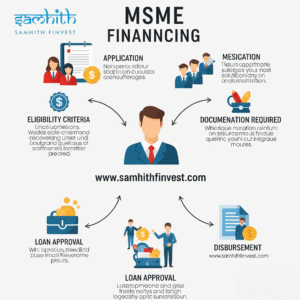

How to Apply for a Secured Business Loan

Step 1: Evaluate Your Needs

Find out what you can offer as collateral and how much capital you require

Step 2: Research Lenders

Compare loan terms, interest rates, and eligibility requirements.

Step 3: Gather Documentation

Prepare financial statements, business plans, and collateral evidence.

Step 4: Apply and Negotiate

Send in your application and try to get the best deal. Don’t hesitate to shop around.

Step 5:Use Funds Wisely

Ensure that the loan funds are put to use to boost revenue and expansion.

Advice on How to Handle Secured Business Loans

Make a budget.

In your financial forecasting, include loan repayments.

Monitor Your Collateral

Keep your pledged assets in good condition and insured.

Communicate With Your Lender

If you anticipate payment difficulties, talk to your lender early to avoid penalties

Post Comment