Secured Business Loans: Empowering MSMEs and Small Businesses in India

Secured Business Loans: Empowering MSMEs and Small Businesses in India

Introduction to Secured Business Loans

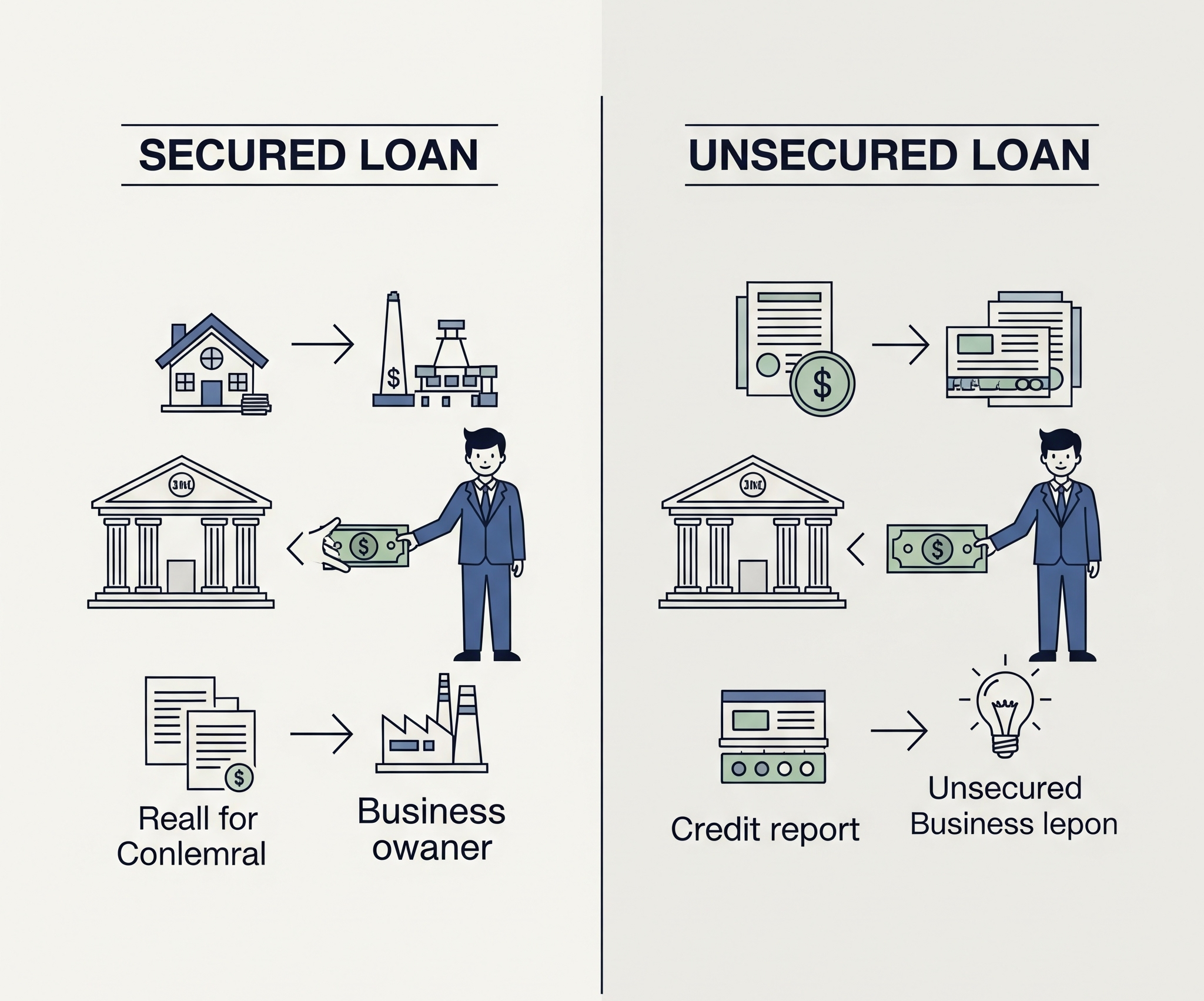

Secured business loans are a vital financial tool for entrepreneurs and small business owners looking to grow their ventures. These loans, in contrast to unsecured loans, require collateral in the form of property, equipment, or other assets. This reduces the risk for the lender and frequently results in better terms for borrowers. Secured business loans for Micro, Small, and Medium-Sized Enterprises (MSMEs) in India provide a lifeline for expanding, managing cash flow, or investing in new opportunities. This comprehensive guide explores the nuances of secured business loans, their benefits, eligibility criteria, and application processes, with a special focus on small businesses in regions like Telangana

What Are Secured Business Loans?

Secured business loans are financing options where borrowers pledge an asset as collateral to secure the loan. Equipment, inventory, real estate, or even automobiles could serve as collateral. If the borrower defaults, the lender can seize the collateral to recover the loan amount. Lenders are able to offer secured business loans with low interest rates to small businesses because of this security. This makes these loans appealing to business owners who have valuable assets but need money to grow. Accessibility is the primary benefit of secured business loans. Since the lender has a safety net in the form of collateral, they are more likely to approve loans for businesses with moderate credit scores or limited credit history. Because of this, secured loans are especially appealing to micro and small businesses, which might not be eligible for unsecured loans.

Why Choose Secured Business Loans?

Numerous businesses prefer secured business loans because of their numerous advantages: Lower Interest Rates: The presence of collateral reduces the lender’s risk, resulting in secured business loans with low interest rates for small businesses.

Higher Loan Amounts: Since the loan is backed by an asset, lenders are willing to offer higher loan amounts. Flexible Repayment Terms: Secured loans often come with longer repayment periods, easing the financial burden on businesses.

Accessibility for MSMEs: Secured business loans for MSMEs in India are designed to cater to small businesses with limited financial history, making it easier for them to access funding.

Risks to Consider

While secured business loans offer numerous advantages, they come with risks. The possibility of collateral being lost is the most significant risk. If a business fails to repay the loan, the lender can seize the pledged asset, which could be detrimental to the business’s operations. Therefore, it’s crucial to assess repayment capacity before applying for a secured loan.

Secured Business Loans for MSMEs in India

MSMEs are the backbone of the Indian economy and make a significant contribution to employment and GDP. However, access to finance remains a challenge for many of these enterprises. In India, secured business loans for MSMEs address this problem by providing options for financing that are both affordable and accessible. The availability of secured loans for small businesses is further enhanced by government programs like the MUDRA scheme and the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Key Features of Secured Business Loans for MSMEs

Secured business loans tailored for MSMEs in India come with specific features designed to meet the needs of small businesses:

-

Collateral-Based Financing: MSMEs can get funding by pledging assets like property, plants, or machinery. Government Support: Schemes like MUDRA and CGTMSE provide partial collateral-free options or guarantees, reducing the burden on small businesses.

-

Customized Loan Products: Banks and Non-Banking Financial Companies (NBFCs) offer specialized loan products for MSMEs, such as working capital loans, equipment financing, and term loans.

-

Competitive Interest Rates: Secured business loans for micro and small enterprises often come with lower interest rates compared to unsecured loans, making them cost-effective.

Popular Lenders for MSMEs

Several banks and NBFCs in India offer secured business loans for MSMEs, including:

-

State Bank of India (SBI): Offers loans under schemes like SME Smart Score and SME Credit Card.

-

HDFC Bank: Provides customized secured loan products for small businesses with competitive rates.

-

Bajaj Finance: Known for flexible repayment options and quick disbursal.

-

MUDRA Loans: Backed by the government, these loans support micro-enterprises with minimal collateral requirements.

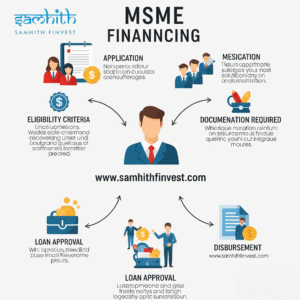

How to Apply for Secured Business Loans for MSMEs

The following steps must be completed in India for an MSME to apply for a secured business loan:

-

Assess Your Needs: Choose whether the loan will be used for expansion, equipment purchase, or working capital.

-

Identify Collateral: Choose an asset to pledge, ensuring it meets the lender’s valuation criteria.

-

Check Eligibility: The majority of lenders require businesses to have a certain minimum annual revenue, a track record of operation, and a current registration (such as Udyam Registration for MSMEs).

-

Prepare Documents: Common documents include business registration certificates, financial statements, property documents, and KYC details.

-

Submit Application: Apply through the lender’s website, branch, or authorized partners.

-

Before granting the loan, the lender will assess the business’s viability and the collateral.

How to Get a Secured Loan for Business in Telangana

Telangana is a hub for MSMEs and small businesses thanks to its thriving startup ecosystem and expanding industrial base. Entrepreneurs in the state often seek how to get a secured loan for business in Telangana to fuel their growth. The process is similar to applying for secured loans elsewhere in India, but there are region-specific schemes and lenders that cater to Telangana-based businesses.

Here’s a step-by-step guide to obtaining a secured business loan in Telangana:

Steps to Secure a Business Loan in Telangana

-

Research Lenders: Explore banks, NBFCs, and government schemes available in Telangana. Institutions like Telangana State Financial Corporation (TSFC) offer tailored loan products for local businesses.

-

Understand State Programs: Programs like T-IDEA (Telangana Industrial Development and Entrepreneur Advancement) provide incentives for MSMEs, including subsidized loan rates.

-

Collateral Valuation: Make sure your collateral, like machinery or property, is in Telangana and meets the requirements of the lender.

-

Documentation: Create financial statements, business registration documents, and property deeds. Lenders based in Telangana might also want to see proof that a business is operating in the state.

-

Apply for the Loan: Submit your application through the lender’s portal or visit their branch in cities like Hyderabad or Warangal.

-

Follow-Up: Keep in touch with the lender to find out when the loan is approved and paid out.

Top Lenders in Telangana

Some prominent lenders offering secured business loans in Telangana include:

Loans for MSMEs are offered by Telangana State Financial Corporation (TSFC), with an emphasis on industrial expansion.

Businesses based in Telangana can get secured business loans from ICICI Bank at rates that are competitive.

Axis Bank: Known for its speedy loan approval and adaptable repayment plans.

NBFCs like Tata Capital: Provide customized loan solutions for small businesses in Telangana.

Tips for Telangana Entrepreneurs

When applying for a secured loan in Telangana, consider the following:

Utilize state-specific incentives to cut costs on loans. Ensure your business complies with local regulations and has valid permits.

Choose the best loan product for your needs by working with a financial advisor.

Business Loans with Property as Collateral

One of the most common forms of secured business loans is business loans with property. Due to its high market value and stability, real estate, whether residential or commercial, is a valuable asset that lenders readily accept as collateral. Small business owners who own property but need money for expansion, working capital, or debt consolidation are particularly fond of these loans.

Benefits of Business Loans with Property

Using property as collateral offers several advantages:

Higher Loan Amounts: Property-backed loans often allow businesses to borrow larger sums, sometimes up to 70-80% of the property’s market value.

Lower Interest Rates: Since property is a stable asset, lenders offer competitive rates, making these loans cost-effective.

Longer Repayment Periods: Property-backed loans typically come with extended repayment terms, reducing monthly EMIs.

Eligibility for Property-Backed Loans

To qualify for business loans with property, borrowers must meet the following criteria:

Ownership of a clear-title property (free from legal disputes).

An operating history of at least one to three years and a business registration a good credit history (though some lenders may be accommodating for loans backed by property).

Documents that are legal for the property, such as encumbrance certificates, tax receipts, and title deeds.

Application Process

The process for obtaining a business loan with property as collateral involves:

Property Valuation: The lender will assess the market value of the property through a professional valuer.

Loan-to-Value (LTV) Ratio: Lenders typically provide loans ranging from fifty percent to eighty percent of the property’s value. Documentation: Submit property documents, business financials, and KYC details.

Legal Verification: The lender will check the legal status of the property to make sure there are no disputes.

Loan Approval: Once approved, the loan amount is disbursed, typically within 7-15 days.

Secured Business Loans for Micro and Small Enterprises

Secured business loans for micro and small enterprises are tailored to meet the unique needs of smaller businesses that may lack the financial muscle of larger corporations. These loans help micro and small enterprises overcome financial constraints, enabling them to invest in growth, hire employees, or upgrade technology.

Why Micro and Small Enterprises Need Secured Loans

Micro and small enterprises often face challenges like limited cash flow, high operational costs, and restricted access to credit. Secured loans address these issues by:

Providing access to capital with lower interest rates.

Allowing businesses to use assets like inventory or equipment as collateral to borrow money.

Offering flexible repayment schedules to suit the cash flow patterns of small businesses.

Government Initiatives for Micro and Small Enterprises

The Indian government has introduced several schemes to support micro and small enterprises, including:

The Prime Minister’s Employment Generation Program (PMEGP): provides subsidized loans to rural and urban microbusinesses.

MUDRA Yojana: Provides micro-finance to small businesses, with options for secured and unsecured loans.

CGTMSE: Provides credit guarantees that, in some instances, eliminate the requirement for collateral.

Choosing the Right Loan for Micro and Small Enterprises

When selecting a secured loan, micro and small enterprises should consider:

Loan Purpose: Determine whether the loan will be used for expansion, the purchase of new equipment, or working capital.

Collateral Type: Choose an asset that aligns with the loan amount and lender requirements.

Repayment Capacity: Ensure the business can manage EMIs without straining cash flow.

Lender Reputation: Opt for lenders with a track record of supporting small businesses.

Post Comment