MSME Financing Fueling Growth for Small and Medium Enterprises

What is MSME Financing?

MSME financing refers to financial support extended to micro, small, and medium enterprises to help them scale operations, improve working capital, and foster innovation. It includes loans, credit lines, subsidies, and government schemes tailored to empower entrepreneurs and businesses.

Understanding the SME Full Form in Corporate Finance

In corporate finance, the SME full form in corporate refers to Small and Medium Enterprises. These entities play a vital role in economic development by generating employment, promoting industrialization, and enhancing exports. Their dynamic nature necessitates flexible sme funding options.

Importance of MSME Financing in Business Ecosystem

MSME financing is essential for:

Improving access to capital for underserved segments

Driving innovation and competitiveness

Creating job opportunities and supporting livelihoods

Strengthening regional economies and rural development

The growing digital ecosystem and ease of credit access have opened new doors for entrepreneurs looking to establish or expand their small and medium business operations.

Types of SME Funding Available in India

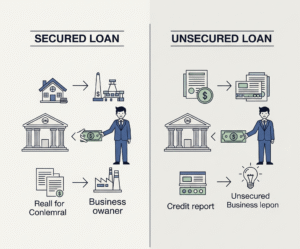

Bank Loans

Traditional banks offer term loans, working capital loans, and overdraft facilities. These options are secure but may involve extensive documentation.

NBFC Financing

Non-Banking Financial Companies (NBFCs) provide customized MSME financing with flexible terms and quicker approvals, particularly useful for new businesses.

Government Schemes

MUDRA Loan

Designed for micro-units, offering credit up to ₹10 lakhs.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

Enables collateral-free loans through partner banks.

Stand-Up India

Caters to SC/ST and women entrepreneurs starting greenfield ventures.

PMEGP (Prime Minister’s Employment Generation Programme)

Supports self-employment projects and small and medium business creation.

Key Benefits of MSME Financing

Access to Working Capital

Many MSMEs suffer from cash flow issues. Efficient MSME financing ensures day-to-day operations continue without disruption.

Business Expansion

Loans can fund infrastructure, hire new talent, and procure advanced machinery, enabling businesses to grow faster.

Improved Creditworthiness

Consistent repayment builds credit history, improving the chances of securing larger funding in the future.

Government Subsidies and Interest Concessions

Schemes like SIDBI’s interest subvention programs reduce the burden on entrepreneurs.

Challenges in Accessing SME Funding

Despite the advantages, MSMEs face several hurdles:

Lack of proper documentation and credit history

High interest rates from unregulated lenders

Limited awareness about available schemes

Complex eligibility criteria in some banks

Innovative fintech platforms and relaxed regulatory norms are bridging these gaps to a great extent.

Who is Eligible for MSME Financing?

MSME financing is available to businesses that fall within the following investment and turnover thresholds:

Micro Enterprise: Investment ≤ ₹1 Cr, Turnover ≤ ₹5 Cr

Small Enterprise: Investment ≤ ₹10 Cr, Turnover ≤ ₹50 Cr

Medium Enterprise: Investment ≤ ₹50 Cr, Turnover ≤ ₹250 Cr

Registration under Udyam portal enhances access to sme funding and government benefits.

Documentation Required

To apply for MSME financing, you need:

Business registration proof (Udyam, GST, or trade license)

PAN and Aadhaar

Bank statements (6–12 months)

Income tax returns

Business plan and quotations (for machinery/equipment loans)

Tips for Securing SME Funding

Maintain Clean Financial Records

Lenders assess your repayment capacity through financial statements. Keep them updated.

Build a Good Credit Score

Timely repayments of loans and credit cards improve your creditworthiness.

Leverage Government Platforms

Portals like psbloansin59minutes.com provide quick loan approvals for eligible MSMEs.

Choose the Right Lender

Compare interest rates, repayment tenure, and processing fees to pick the most cost-effective financing solution.

Digital Lending for MSMEs

The digital revolution has enabled paperless and faster loan disbursements through:

Fintech startups offering app-based credit

Digital KYC and Aadhaar-based e-signatures

API-integrated platforms that verify financials in real-time

This evolution has made MSME financing more accessible to first-time borrowers and small and medium business owners in remote areas.

Sector-Specific MSME Financing Options

Manufacturing Sector

Credit for raw materials, equipment purchase, and infrastructure.

Retail and Wholesale Trade

Working capital to manage seasonal inventory and staff salaries.

Agro-Based Units

Funding for machinery, storage, and export readiness.

Technology Startups

Early-stage and Series-A funding supported by angel investors and government initiatives.

What is SME Contribution to the Economy?

India’s SMEs account for 30% of the GDP and 48% of exports. They generate over 110 million jobs across urban and rural areas. Thus, increasing the flow of MSME financing is vital to sustain this backbone of the economy.

MSME Financing: Global Perspective

Countries like the UK, USA, and Germany offer robust credit guarantees and low-interest funding to SMEs. India is fast catching up with policy reforms, including the Emergency Credit Line Guarantee Scheme (ECLGS) and SIDBI’s cluster development programs.

The Future of MSME Financing

The coming years will see:

AI-based loan approval systems

Increased peer-to-peer lending platforms

Blockchain for transparent disbursal and tracking

Credit scoring models using alternative data

All these trends make MSME financing more inclusive and responsive to the needs of modern entrepreneurs.

Conclusion: Empowering Dreams with MSME Financing

MSME financing is not just a support system—it’s a catalyst for entrepreneurship, innovation, and inclusive growth. From easing working capital woes to enabling digital transformation, funding solutions tailored for small and medium business units unlock their true potential.

The government, private sector, and fintech companies must work together to ensure fair, accessible, and timely credit to this vital segment. With the right strategy and financial support, India’s SME sector can continue to lead the charge toward a resilient economy.

Post Comment