SME Business Loan: A Comprehensive Guide for Small Enterprises

Introduction to SME Business Loan

Small and Medium Enterprises (SMEs) are the backbone of the Indian economy. To support their growth, financial institutions offer SME business loans, which provide the capital needed for expansion, equipment purchase, inventory, and working capital requirements.

Small and medium-sized enterprises (SMEs) will make up nearly 30% of India’s GDP by 2025, making SMEs loans in India an essential part of economic growth. This blog explores how these loans work, their benefits, application process, and current trends like the sme finance forum 2025.

Understanding SME Business Loans

What is an SME Business Loan?

An SME business loan is a type of financing specially designed to meet the requirements of small and medium enterprises. The majority of these loans are unsecured, offer quick disbursement, require little documentation, and have a variety of repayment options.

Who Can Apply?

Any business falling under the MSME classification as defined by the Indian government can apply. These include manufacturers, traders, retailers, and service providers.

Benefits of SME Business Loans

Easy Accessibility

Accessing a small business loan is now easier and faster thanks to the proliferation of NBFCs and digital banking.

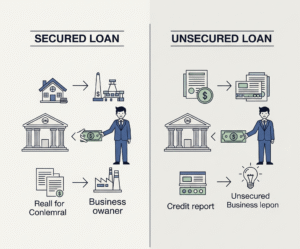

Unsecured Options

The absence of collateral on the majority of small business loans in India lowers the risk for entrepreneurs.

Competitive Interest Rates

Thanks to government-backed programs, banks and NBFCs now offer lower interest rates.

Flexible Repayment Tenure

Depending on the loan amount and financial profile, tenures can range from 12 months to 5 years.

Types of SME Loans Available in India

Working Capital Loans

These are short-term loans meant to cover operational expenses like salaries and rent.

Machinery Loans

used to acquire or upgrade machinery that aids in productivity enhancement.

Term Loans

These are long-term sme business loans for major capital expenditures.

Line of Credit

A revolving credit facility to meet continuous funding needs.

Government Schemes Supporting SME Finance

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

This scheme offers credit guarantees to financial institutions that provide loans to SMEs.

Mudra Loans

Part of the Pradhan Mantri Mudra Yojana (PMMY), this loan is ideal for micro-enterprises.

Stand-Up India

Promotes entrepreneurship among women and SC/ST communities with special sme business loan provisions.

SME Finance Forum 2025: What to Expect

Overview of SME Finance Forum 2025

A global platform devoted to inclusive financing strategies for SMEs is the sme finance forum 2025. To close the gap in small business finance, it brings together regulators, fintechs, and financial institutions.

Key Discussions

Digital transformation, AI-driven credit evaluation, and collaborative finance models are emphasized at the 2025 forum.

India’s Role

India’s participation is crucial in this year’s forum, with discussions on improving sme loans in india through tech-based underwriting.

The SME Finance Gap: A Real Challenge

Understanding the SME Finance Gap

The sme finance gap refers to the unmet demand for capital among SMEs. Many small businesses, despite their potential, are unable to obtain credit because they lack collateral, have poor credit histories, or operate in an informal manner.

Global and Indian Statistics

The SME finance gap is estimated to be $5.2 trillion worldwide. In India, it is around ₹25 lakh crore, highlighting the urgency for policy and banking reforms.

Addressing the Gap

The focus of many NBFCs and digital lenders is to bridge this gap by offering innovative, low-documentation loans.

How to Apply for an SME Business Loan

SME Finance Login and Application Steps

The majority of NBFCs and banks have made use of digital portals like the sme finance login systems to streamline the application process.

Step-by-Step Guide

Visit the Lender’s Website

Use the sme finance login page to begin your application.

Fill Application Form

Provide business details, turnover, and loan requirements.

Upload Documents

Submit KYC, ITRs, bank statements, and business proof.

Verification & Approval

If eligible, the loan is approved within 48–72 hours.

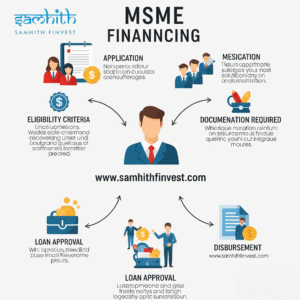

Documents Required for SME Loans in India

Standard Documentation

KYC Documents

Aadhar, PAN, and GST certificate

Financial Statements

Bank statements for the last 6 months and ITRs for the past 2 years

Business Proof

Udyam Registration or Trade License

Eligibility Criteria for SME Business Loans

Business Age and Turnover

Minimum of 2 years in operation and annual turnover of ₹10 lakh or more.

Credit Score

Typically, a CIBIL score of 650 or higher is required.

Business Registration

The company should be a registered MSME under Indian laws.

Top Banks and NBFCs Offering SME Loans in India

Leading Institutions

HDFC Bank

Offers up to ₹50 lakh with fast digital approval.

ICICI Bank

Provides overdraft and working capital loans under its SME lending schemes.

SIDBI (Small Industries Development Bank of India)

Specializes in sme business loan and refinancing.

Bajaj Finserv

Popular NBFC known for quick disbursal and minimal documentation.

Tips for Getting Your SME Loan Approved

Maintain Accurate Records

Ensure your books of accounts are up to date.

Improve Your Credit Score

Pay off existing debts to boost your CIBIL score.

Have a Clear Business Plan

Banks prefer borrowers who demonstrate a strong repayment capacity and growth roadmap.

Technology and SME Financing

Role of Fintech in SME Lending

Digital lenders are using AI, blockchain, and big data to simplify credit evaluation.

Advantages of Fintech

Real-Time Loan Approval

Personalized Offers Based on Business Behavior

Instant Disbursals to Bank Accounts

Common Mistakes to Avoid When Applying

Not Checking Eligibility

Always ensure your business meets the lender’s requirements.

Ignoring the Fine Print

Understand prepayment charges, processing fees, and penalties.

Applying with Incomplete Documents

This can lead to unnecessary delays or rejection.

Future of SME Financing in India

What Lies Ahead?

With initiatives like ONDC and digital India, sme loans in india will see massive transformation through integration and digitization.

Digital Credit Ecosystems

Collaborations between fintechs and banks will ensure better access and lower costs.

Increased Regulatory Support

The government is expected to introduce more schemes post the sme finance forum 2025 discussions.

Conclusion: Empowering SMEs Through Loans

An SME business loan is more than just financial support; it’s a growth enabler. With the rising popularity of platforms like the sme finance forum 2025, and digital tools like sme finance login, SMEs are better placed to bridge the sme finance gap and realize their full potential.

Understanding and utilizing sme loans in India can put you on the fast track to success, whether you are a new business owner or an established one.

Post Comment