MSME Loans: Not Free, But Super Helpful for Your Business

MSME Loans: Not Free, But Super Helpful for Your Business!

Are you a small business owner in India? You might have heard people say, “Are MSME loans free?”

Many people think this, maybe from what they see online or hear from friends. But the quick and honest answer is:

❌ No, MSME loans are not free. You still have to pay a little extra money back, called interest.

But guess what? This doesn’t mean they’re bad! Actually, they’re really good and can help your business a lot.

In this blog post from Samhith Finvest, we’ll tell you the real story about MSME loans. We’ll show you why they’re smart for your business.

🔍 What is an MSME Loan?

MSME stands for Micro, Small, and Medium Enterprises. These are little and medium-sized businesses that help India a lot by making things and giving jobs.

To help these businesses grow, the government and banks offer MSME loans. These are special loans just for smaller businesses.

You can use these loans for:

- Making your business bigger

- Buying new machines

- Getting money for daily needs

- Hiring more people

- Paying for everyday things your business needs

Now, let’s talk about the big idea that’s not true.

❌ The Big Idea That’s Not True: MSME Loans Are Free

Many people think MSME loans cost nothing (0% interest). This idea might come from government programs or news that talks about getting some money back on interest.

But here’s the truth:

There are no MSME loans in India that are totally free.

Banks and other money lenders will always add a little extra money to your loan, which is the interest. Even if the government helps, you still pay some interest.

✅ The Real Story: MSME Loans Are Not Free, But They Save You Money!

Even though you pay interest, MSME loans are still a great deal. Here’s why they are so good:

🟢 1. You Get Some Interest Money Back!

The Indian government has programs that give you some of your interest money back. It can be like 2% or 5% of what you paid!

💡 Example:

- If your loan interest is 10%, and you get 2% back, it’s like you only paid 8%!

- This means you still pay interest, but you pay less, making your loan cheaper!

🏆 Main Idea: Getting interest money back helps you save money without needing to put up anything valuable.

🟢 2. Lower Interest Rates – Cheaper Than Regular Loans!

MSME loans often have lower interest rates than normal business loans.

Banks and lenders can offer lower rates (sometimes starting at 7% or 8%) because the government wants to help small businesses.

✅ This can save you a lot of money over time!

Especially if you get help from experts like Samhith Finvest, you can find the very best and cheapest rates for your business.

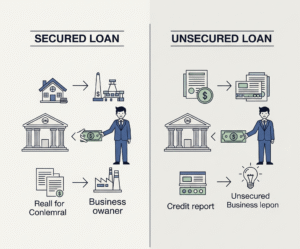

🟢 3. No Collateral Needed – No Assets Required!

Sometimes, to get a loan, banks ask you to put up something valuable you own, like land or a building. This is called collateral. But for many MSME loans, you don’t need any!

These loans are:

- No collateral needed!

- The government helps promise you’ll pay it back.

- Often, it’s easy to get them with just a few papers.

🧾 No property? No problem! You can still get money for your business.

This is great for new businesses or small shops that don’t have many big things to offer as collateral.

🟢 4. Easy to Get and Faster Money!

Most MSME loans are made to help new and growing businesses.

It’s simpler to get them with just a few things like:

- A GST registration (a number for your business)

- Tax papers from 1 or 2 years

- Basic ID papers

- An Udyam registration (another business number)

…you can apply fast and get the money in just a few days, especially if Samhith Finvest helps you!

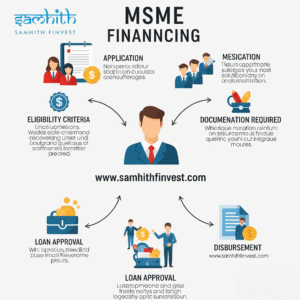

🟢 5. Government Programs You Can Use!

Here are some popular MSME programs you should know about:

| Program Name | What it Helps With |

|---|---|

| CGTMSE (Credit Guarantee Scheme) | Loans up to ₹2 crore without needing collateral |

| PMEGP (Prime Minister’s Employment) | Money to help start new small businesses |

| Stand-Up India | Loans for women and people from certain groups (SC/ST) |

| MUDRA Loans (under PMMY) | Loans up to ₹10 lakh for very small businesses |

| Emergency Credit Line Guarantee Scheme | Extra loans during hard times, like COVID-19 |

Samhith Finvest, we help you find the best program for your business and help you apply for it.

💬 Why This Matters to You

Let’s be honest – you need money to make your business bigger. Whether it’s to get better machines, buy more things to sell, or hire more people, your business needs money to grow.

MSME loans are made just for this reason.

💡 No, they aren’t free. But yes, they’re smart, safe, and can help your business get bigger.

🧭 How Samhith Finvest Helps You Get the Best MSME Loan

At Samhith Finvest, we do more than just connect you to a bank. We help you every step of the way, from picking the right program to doing the papers and getting your money.

Here’s what you get when you work with us:

✅ We give you personal advice on MSME loans.

✅ We help you with all your papers.

✅ We track your application until you get the money.

✅ We give you expert advice on getting money back and other programs.

✅ We work with top banks and lenders.

Our goal? To get your business money with less trouble and more savings!

📞 Ready to Grow Your Business?

Don’t let wrong ideas stop your business.

Let Samhith Finvest help you find the best MSME loan options today.

✅ Get lower interest rates!

✅ Get money back on interest!

✅ Don’t worry about collateral!

✅ Focus on making your business bigger!

📞 Contact us now or visit Samhith Finvest to apply today!

✅ Final Words: Simple Recap for Smart Business Owners

MSME loans are not free, but they offer low interest, easy steps, and no need for property. With help from Samhith Finvest, you get the best support to grow your business fast. Apply today and turn your business dream into success!

Post Comment