SME Loans Eligibility: Complete Guide for Small Business Owners

Introduction to SME Loans

Small and Medium Enterprises (SMEs) are the backbone of India’s economy. To support their growth, banks and NBFCs offer specialized loans known as SME loans. But before applying, it’s essential to understand the SME loans eligibility criteria. This blog will provide an in-depth view of the eligibility requirements, factors that influence approval, and how to improve your chances of getting an SME loan.

What is SME Loan?

Understanding SME Finance

What is SME loan? It refers to a financial product offered by banks and financial institutions to support the capital and operational needs of small and medium enterprises. SME loans are available for various purposes including expansion, equipment purchase, working capital, and marketing.

Key Features

Loan amount typically ranges from INR 50,000 to INR 5 crore.

Repayment tenure from 12 to 60 months.

Collateral-free options available.

Quick processing and minimal documentation.

Why SME Loans Are Crucial for Growth

Empowering India’s Business Landscape

India has over 63 million MSMEs, contributing nearly 30% to GDP. Timely access to SME funding enables businesses to grow, sustain operations, and compete globally. Understanding SME loans eligibility ensures your application stands out and reduces rejection chances.

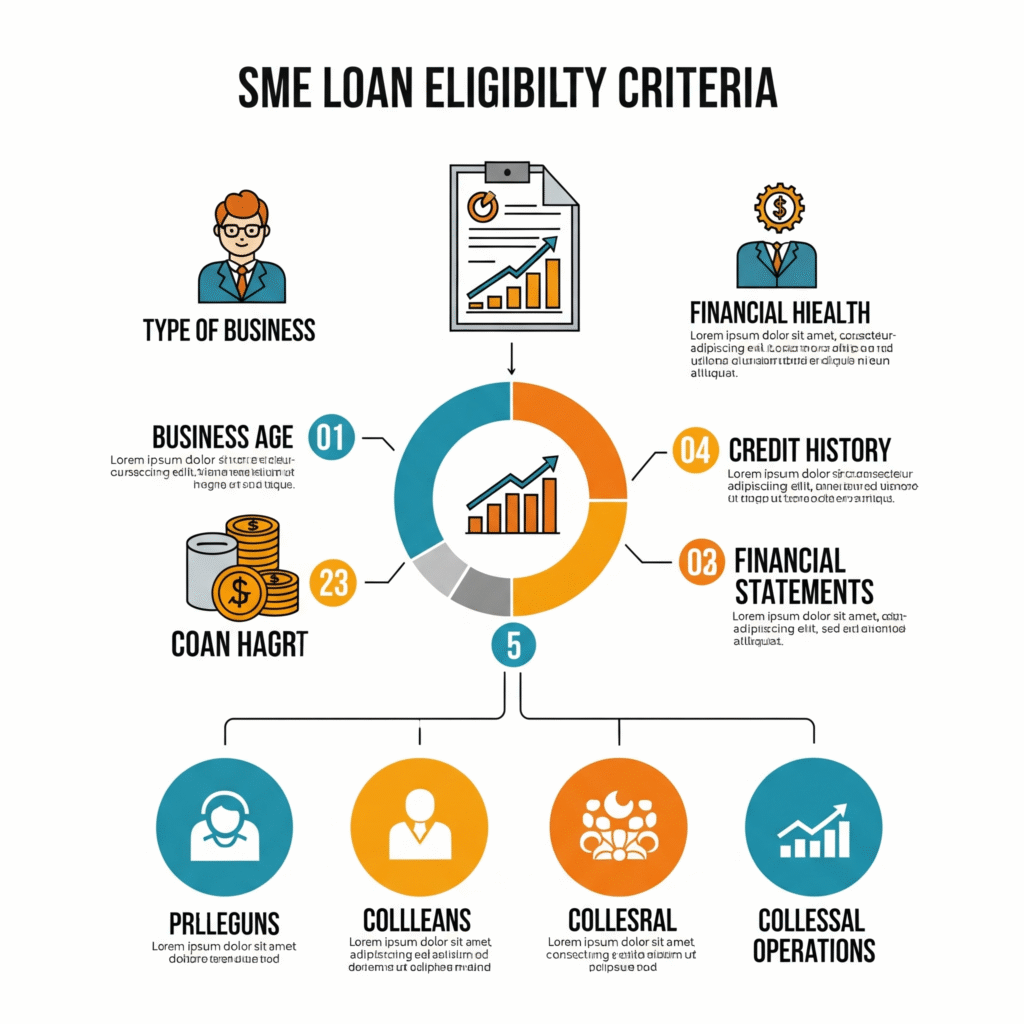

SME Loans Eligibility Criteria

General Eligibility Requirements

To qualify for an SME loan, most financial institutions expect the applicant to meet the following conditions:

Business Type

Sole proprietors, partnership firms, LLPs, private limited companies.

Registered under MSMED Act or Udyam registration.

Business Vintage

Minimum 1 to 3 years of business operation.

Turnover Requirements

Annual turnover must typically range between INR 10 lakhs to INR 10 crores, depending on the lender.

Credit Score

A good credit score (650 and above) is often essential for quick approval.

Income Tax Returns

Should have filed ITRs for at least 1-2 years.

Bank Statement

Business account statements for the last 6-12 months.

Documents Required for SME Loan

PAN Card and Aadhar Card (for individual/partners/directors)

Business registration proof

ITR for last 2 years

Bank statements

GST registration and returns

Proof of business address

Financial statements (Profit & Loss, Balance Sheet)

Factors Affecting SME Loans Eligibility

Business Stability

Lenders assess the stability of your business before approving your loan. If your business has regular cash flow and minimal outstanding debt, your chances improve.

Creditworthiness

Credit history of the applicant and the business plays a critical role. Make sure to clear old dues and maintain a clean repayment record.

Industry Type

Certain industries are considered high-risk. If your business belongs to a high-risk sector, your SME loans eligibility may be restricted.

How to Improve SME Loans Eligibility

Maintain a Strong Credit Score

Pay your EMIs and credit card dues on time. Avoid defaults.

Keep Finances Transparent

Maintain up-to-date records. Submit accurate tax returns and financial statements.

Apply with Proper Documentation

Missing or incomplete documents can cause rejections. Double-check everything before submission.

Comparing MSME Loan Interest Rate

Public Sector Banks

Interest rates range from 7% to 13% annually.

Private Sector Banks

Rates range between 10% to 18% based on creditworthiness.

NBFCs and FinTech Lenders

They may offer flexible criteria but higher interest rates ranging from 15% to 28%.

MSME loan interest rate varies based on loan amount, tenure, credit score, and lender policies.

Where to Find SME Loans Near Me

Online Marketplaces

You can search for SME loans near me using loan aggregator websites and apps. These platforms compare different loan offers in your location.

Local Banks and NBFCs

Visit your nearby bank branch or NBFC offices. Many also provide doorstep services for document collection and verification.

Government Schemes

Look for subsidized loan schemes under MUDRA, CGTMSE, and Stand-Up India to get favorable terms.

Types of SME Loans in India

Working Capital Loans

To meet daily operations and short-term obligations.

Term Loans

Used for asset purchase, infrastructure development, and expansion.

Equipment Finance

For purchasing machinery and tools.

Invoice Financing

Helps businesses manage delayed client payments.

Overdraft Facility

Flexible borrowing limit based on current account activity.

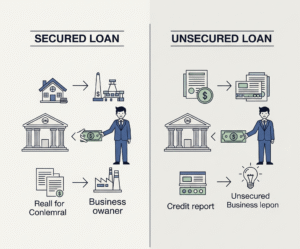

SME Funding Options

Government Funding

MUDRA Loans

Credit Guarantee Scheme (CGTMSE)

PMEGP

Private Funding

Angel Investors

Venture Capital

FinTech lenders

SME funding is essential for scalability. Explore both secured and unsecured options.

Benefits of Availing SME Loans

Builds business credit profile

Funds expansion and diversification

Helps in managing cash flow

Offers tax benefits on interest paid

Enhances production capacity

Common Mistakes That Lower Eligibility

Inconsistent banking activity

High existing debts

Lack of registration under MSMED Act

Poor credit score

Incomplete paperwork

Best Practices While Applying for SME Loans

Research and Compare

Explore options online. Use keywords like SME loans near me or check government portals.

Consult Experts

Financial advisors can help you assess SME loans eligibility and suggest the best lender.

Keep Documents Ready

Organized records speed up processing and boost approval chances.

Future of SME Loans in India

As digital banking and fintech adoption grows, accessing SME funding will become easier, faster, and more transparent. AI-based underwriting and alternate credit scoring will soon revolutionize SME loans eligibility criteria.

Conclusion

To sum up, understanding and meeting the SME loans eligibility criteria is the first step toward securing business funding. Whether you’re a startup or an established enterprise, fulfilling the right conditions and maintaining financial discipline can help you qualify for an SME loan easily.

Make sure to check your SME loans eligibility, compare MSME loan interest rate, look for SME loans near me, and understand what is SME loan thoroughly. Also, explore all SME funding options to support your business’s long-term success.

Post Comment