Eligibility for Unsecured Business Loan: All You Need to Know

eligibility for unsecured business loan: Getting a business loan without offering collateral is a major boon for startups and MSMEs. But before you apply, you need to know if you eligibility for an unsecured business loan and how to get the most out of it.

An in-depth look at unsecured business loans, eligibility requirements, required documents, benefits, and frequently asked questions for Indian entrepreneurs and small business owners are all covered in this guide.

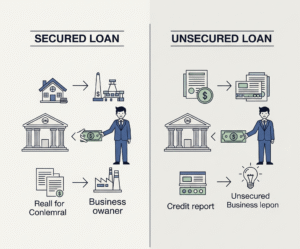

What is an Unsecured Business Loan?

A credit facility that does not require any kind of collateral or security is known as an unsecured business loan. The borrower’s creditworthiness, business performance, income tax records, and other financial indicators are used to approve these loans.

Features of Unsecured Business Loans

No collateral or assets required

Quick approval and disbursal

Short to medium-term repayment tenures

Ideal for MSMEs, startups, and small businesses

Interest rates typically higher than secured loans

Importance for Startups and MSMEs

Startups and small businesses frequently lack pledgeable assets. An unsecured MSME loan eligibility for startups provides these businesses the critical push they need to scale operations, purchase inventory, hire staff, or expand reach.

Eligibility for Unsecured Business Loan

Let’s now deep dive into the core of this article — eligibility for unsecured business loan in India.

Basic Eligibility Criteria

Most banks and NBFCs follow these minimum requirements:

-

Age: 21 to 65 years

-

Business vintage: At least 1 year in operation

-

Annual turnover: Minimum ₹10 Lakhs (may vary)

-

Credit Score: 650 or above

-

Business type: Proprietorship, Partnership, Pvt. Ltd., or LLP

-

Location: Should be in approved urban or semi-urban zones

Eligibility for Startups

-

Startups with a stable monthly revenue stream

-

Minimum 6 months of operations (for select fintech lenders)

-

Business must be registered (Udyam/MSME/ROC)

-

Promoter with a good credit score or repayment history

Eligibility for MSMEs

-

Should be registered under the MSME Act

-

Annual turnover and GST returns supporting financial strength

-

Positive bank statements over the last 6 months

-

Business should not be blacklisted or in default

Other Factors Considered

-

Debt-to-income ratio

-

Cash flow consistency

-

Existing EMIs

-

Nature of industry

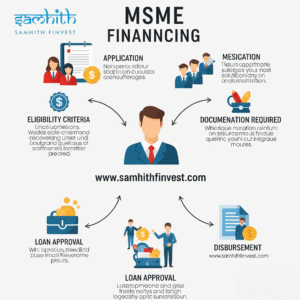

How to Apply for Unsecured Business Loan

Applying is simple and digital today. Here’s how to apply unsecured business loan in a few easy steps:

Online Application Steps

Choose a reputed lender (bank, NBFC, or fintech)

Fill out the online form with PAN, Aadhaar, GSTIN, and business details

Upload scanned copies of:

Bank statements (last 6–12 months)

Income tax returns

GST returns

Business registration documents

Submit application and await approval

Documents Required

PAN Card of business and owner

Aadhaar Card

Business address proof

6–12 months of bank statements

GST certificate and filings

Income tax returns (last 2 years)

Business registration or incorporation certificate

Benefits of Unsecured Business Loans

Why Choose an Unsecured Business Loan?

No asset risk

Fast processing (within 24–72 hours)

Suitable for all business types

No end-use restrictions

Helps build credit history

FAQs

1. Can a new business get an unsecured loan?

Yes, startups can qualify if they show stable revenues and strong promoter credit.

2. Is a credit score necessary for unsecured loans?

Yes, most lenders prefer a credit score above 650.

3. What is the maximum amount available?

Loans range from ₹50,000 to ₹50 Lakhs depending on eligibility and lender policies.

4. How fast is disbursal?

Online lenders disburse within 24–48 hours post document verification.

5. Do I need to show profits to qualify?

Not always. Consistent revenues and good cash flow matter more.

Understanding the eligibility for unsecured business loan is the first step toward fueling your startup or MSME’s growth. Whether you’re applying for your first loan or looking to expand, choosing the right lender and meeting the criteria increases your approval chances.

For a smooth experience, maintain updated financial records, monitor your credit score, and apply for the right amount as per your business’s repayment ability.

Post Comment