Unsecured Business Loan for Startup: A Complete Guide

unsecured business loan for startup: The journey of starting a startup is exhilarating and full of ambition, creativity, and difficulties. One of the major hurdles most entrepreneurs face is funding. While there are numerous financing options available, one solution that stands out due to its flexibility and accessibility is the unsecured business loan for startup.

Everything you need to know about unsecured startup loans, including how they work, the best lenders, regional options in India and Hyderabad, and how to increase your chances of approval, will be covered in this comprehensive guide. Let’s begin.

What is an Unsecured Business Loan for Startup?

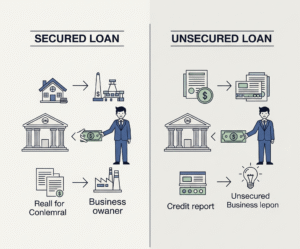

Understanding Unsecured Business Loans

A type of financing that does not require collateral is an unsecured business loan. This means startups can access funds without pledging any assets. Unlike secured loans, where failure to repay might lead to asset seizure, unsecured loans are granted based on creditworthiness, financials, and the potential of your startup.

Key Features of Unsecured Loans for Startups

No collateral required

Quick disbursal

Flexible tenure options

Fixed or floating interest rates

Available from banks, NBFCs, and fintech lenders

Why Choose an Unsecured Business Loan for Startup?

1. No Asset Risk

Since you’re not pledging any property, machinery, or inventory, your personal and business assets are protected. For startups in their early stages with limited resources, this is critical.

2. Fast Processing and Disbursal

Funds are disbursed quickly, sometimes within 24 to 72 hours, thanks to the online application process and the minimal documentation required.

3. Improve Business Credit Score

An unsecured loan that is paid back on time can help your startup build a strong credit profile, which will make it easier to raise money in the future.

4. Ideal for Short-Term Needs

These loans are perfect for covering initial expenses like hiring, marketing, technology development, or working capital.

Types of Unsecured Business Loans in India

1. Term Loans

Fixed tenure and interest rate. Ideal for planned expenses such as product development or marketing.

2. Line of Credit

Borrow as needed up to a fixed limit. Only pay interest on the amount used.

3. Merchant Cash Advance

Based on daily credit card sales. Great for retail-based startups.

4. Invoice Financing

Lenders provide funds against pending invoices. Helps with cash flow management.

Best Unsecured Business Loans in India

Finding the right lender can be a game changer. Here are some top options offering the best unsecured business loans for startups in India:

Finding the right lender can be a game changer. Here are some top options offering the best unsecured business loans for startups in India:

1. HDFC Bank

Loan Amount: ₹50,000 to ₹50 lakhs

Interest Rate: Starting at 11.90%

Tenure: Up to 4 years

2. ICICI Bank

Special startup loan schemes

Customizable repayment

Minimal documentation

3. Tata Capital

Multiple business loan variants

Loan tenure up to 3 years

Special offers for women entrepreneurs

Unsecured Business Loans in Hyderabad: Regional Options

Hyderabad is a booming startup hub with fintechs, biotech firms, and tech innovators. Let’s explore unsecured business loans in Hyderabad.

1. Telangana State Industrial Infrastructure Corporation (TSIIC)

-

Government-supported schemes

-

Startup-specific subsidies

-

Advisory and mentoring included

2. Andromeda Loans

-

Strong presence in Hyderabad

-

Partnership with 30+ lenders

-

Ideal for first-time entrepreneurs

3. SBI Startup Assist

-

Tailored startup financing options

-

Unsecured loans up to ₹20 lakhs

-

Available through local branches

4. Local NBFCs and Co-operative Banks

Many regional NBFCs offer tailored unsecured loans for early-stage businesses, especially in real estate, logistics, and IT.

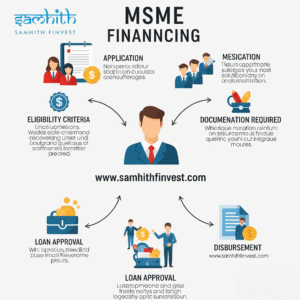

Eligibility Criteria for Unsecured Business Loan for Startup

Though criteria may vary, most lenders follow a standard set of eligibility conditions.

Basic Requirements

-

Age: 21 to 65 years

-

Business vintage: 6 months to 2 years

-

Monthly turnover: ₹1 lakh or more

-

Good credit score (650 and above)

Documents Required

-

PAN and Aadhar

-

Business registration proof

-

Bank statements (6-12 months)

-

Income tax returns (if applicable)

-

Business plan or pitch deck (for startups)

How to Apply for an Unsecured Business Loan for Startup

Step-by-Step Guide

Check Eligibility – Use online eligibility checkers.

Compare Lenders – Look for best rates, terms, and customer service.

Submit Application – Online or offline with required documents.

Undergo Verification – Credit score, bank statement analysis, business viability.

Receive Offer & Disbursal – Review the offer and receive funds upon acceptance.

Tips to Increase Approval Chances

1. Maintain a Good Credit Score

A score of 700+ significantly improves your chances of approval and helps you negotiate better interest rates.

2. Present a Strong Business Plan

Highlight how the loan will help your startup grow and generate revenue.

3. Build Business Vintage

Operate officially and maintain consistent income for at least 6 months before applying.

4. Choose the Right Loan Amount

Don’t overborrow. Apply for what you can reasonably repay based on your cash flow forecast.

Alternatives to Unsecured Business Loans for Startups

If you’re not eligible for an unsecured loan, consider the following:

1. Angel Investors

Equity-based investment with mentorship and network access.

2. Venture Capital

Ideal for high-growth startups, although difficult to obtain.

3. Government Schemes

Startup India

Mudra Loan Yojana

SIDBI Make in India Loan for Enterprises (SMILE)

4. Crowdfunding

Use platforms like Kickstarter or Indiegogo to raise funds without debt.

Is an Unsecured Business Loan Right for Your Startup?

An unsecured business loan for startup is an excellent option if you need quick capital without risking your assets. Whether you’re in the early product development stage or scaling operations, this form of financing offers the flexibility and speed that modern startups need.

By choosing the best unsecured business loans in India or exploring unsecured business loans in Hyderabad, you can secure the funding necessary to transform your vision into reality.

Post Comment