Secured vs unsecured business loans

Secured vs Unsecured Business Loans: Choosing the Right Funding Option for Your Business

Business Financing Options

Access to capital is crucial for businesses aiming to expand, manage operations, or invest in new opportunities. Business loans are one of the most common ways to obtain funding. Among the different types of loans available, two primary categories are secured business loans and unsecured business loans. Entrepreneurs can make more informed decisions that are in line with their business objectives if they are aware of the key distinctions between these two.

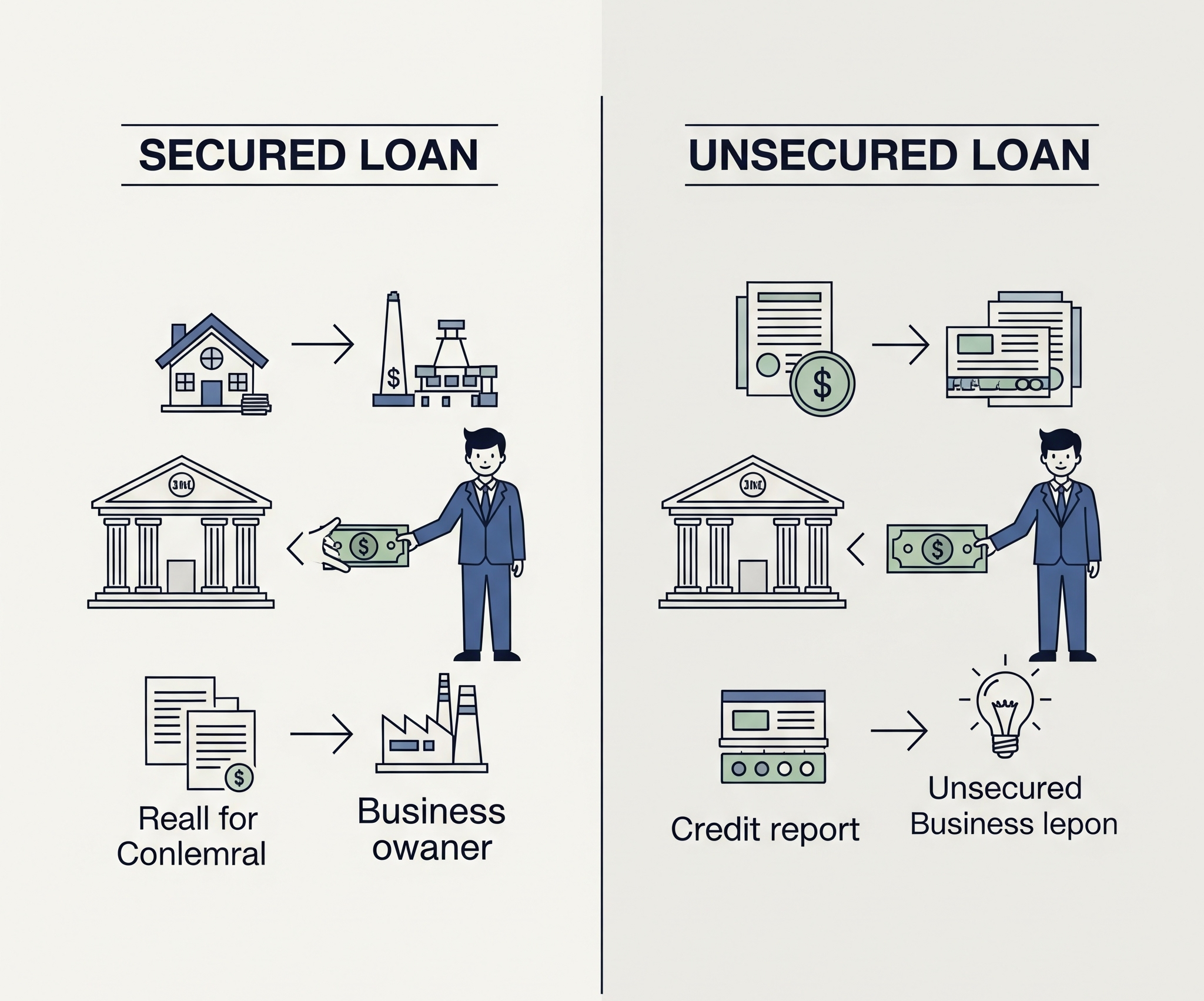

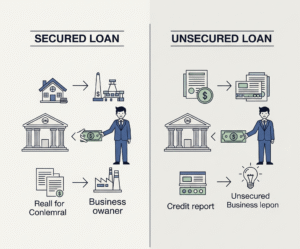

What Are Secured Business Loans?

Definition and Overview

Loans for businesses are known as secured business loans when the borrower is required to provide collateral in the form of real estate, machinery, inventory, or other valuable business assets. The lender reduces their risk in the event that the borrower defaults by using this collateral as security.

How Secured Loans Work

In the event of non-payment, the lender has the legal right to seize and sell the collateral to recover the outstanding debt. Secured loans frequently come with more favorable terms and interest rates as a result of the lenders’ reduced risk.

Common Types of Collateral

Real estate (commercial or personal)

Business equipment

Inventory or stock

Receivables from customers Vehicles

Benefits of Secured Business Loans

Lower Interest Rates

Lenders are more willing to offer competitive interest rates because the risk is mitigated by the collateral.

Higher Loan Amounts

With secured loans, the lender has assurance in the form of assets, so businesses may be eligible for larger loan amounts.

Flexible Repayment Terms

Secured loans often offer extended repayment periods, making it easier for businesses to manage their cash flow.

Easier Approval Process for Some Businesses

If businesses or startups with subpar credit are able to provide valuable collateral, they may have an easier time getting approved for a secured loan.

Risks of Secured Business Loans

Asset Seizure

You run the risk of losing the assets associated with the loan if your company fails to repay the loan.

Lengthy Application Process

The valuation and verification of collateral can lengthen and complicate the application process.

Risk of Overleveraging

It is possible for business owners to overestimate their ability to repay, putting important assets in jeopardy.

What Are Unsecured Business Loans?

Definition and Overview

Business loans that are not secured don’t need any collateral. Instead, they are granted based on the borrower’s creditworthiness, financial history, and business performance.

How Unsecured Loans Work

Lenders heavily rely on credit scores, cash flow statements, and business plans to assess risk because there is no collateral involved. These loans typically carry higher interest rates and may come with stricter repayment terms.

Types of Unsecured Loans

Business lines of credit

Merchant cash advances

Business credit cards

Term loans

Benefits of Unsecured Business Loans

No Collateral Required

This is a significant advantage for businesses without substantial assets to pledge.

Faster Approval

When compared to secured loans, the application and approval processes typically take less time.

Suitable for Short-Term Needs

Ideal for covering short-term cash flow gaps, payroll, or emergency expenses.

Risks of Unsecured Business Loans

Higher Interest Rates

Due to increased risk for lenders, unsecured loans often carry significantly higher interest rates.

Stricter Qualification Criteria

Strong credit scores and a solid financial history may be required by lenders.

Personal Guarantee Requirement

A personal guarantee may be required by some lenders, putting your personal finances in jeopardy.

Secured vs Unsecured Small Business Loan: A Detailed Comparison

Interest Rates

Secured loans typically have lower interest rates, while unsecured loans carry higher costs.

Loan Amounts

Higher amounts can generally be borrowed with secured loans.

Repayment Terms

The repayment terms of secured loans are more adaptable and frequently span several years.

Approval Time

Due to the absence of collateral requirements, unsecured loans may be processed more quickly.

Risk to Borrower

Unsecured loans may put your personal credit at risk or require a personal guarantee, whereas secured loans put business assets at risk.

Best Loan Type for Small Businesses

Factors to Consider

Availability of Assets: Do you have valuable assets that you can pledge? Credit Score: Is your credit score strong enough to qualify for unsecured loans?

Loan Purpose: Are you funding long-term investments or short-term operational needs?

Urgency: How quickly do you need the funds?

When to Choose Secured Loans

when you want a big loan amount

When lower interest rates are a priority

When your business has substantial collateral

When to Choose Unsecured Loans

When you need quick capital access

When you lack collateral

When you need money for immediate expenses

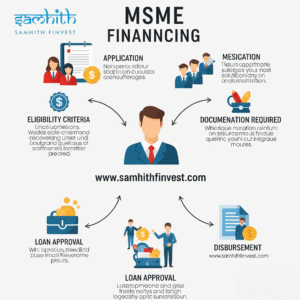

Investment Products for Businesses

Businesses today have multiple financing options beyond traditional loans. Products for investing in business expansion include:

Equipment Financing

Great for purchasing or leasing business equipment with the equipment itself as collateral.

Invoice Financing

enables companies to borrow against unpaid invoices, which is ideal for enhancing cash flow.

Merchant Cash Advances

offers a one-time payment in exchange for a share of future sales. These are high-priced, quick-access options.

Business Lines of Credit

Revolving credit that businesses can draw from as needed, offering flexibility.

Choosing Between Secured and Unsecured Loans

Assessing Your Business Needs

Every business is unique. It’s essential to evaluate your financial health, available assets, and funding objectives.

Consult Financial Advisors

A loan specialist or financial advisor can assist you in selecting the most suitable method of funding based on your particular circumstances.

Read the Fine Print

Always scrutinize loan terms, including interest rates, repayment schedules, and penalties. Understand the full cost of borrowing before signing any agreement.

Post Comment