How to Get a Secured Business Loan

How to Get a Secured Business Loan

How to Get a Secured Business Loan ,If you’re a small business owner or startup founder looking to fund your business growth, you might be wondering, what’s the safest way to get funding without sky-high interest rates? The answer might just be a secured business loan.

How to Get a Secured Business Loan In this blog, we’re going deep into what secured business loans are, how they work, how to qualify, and how to get the best deal—even if your credit isn’t perfect.

Understanding Secured Business Loans

What is a Secured Business Loan?

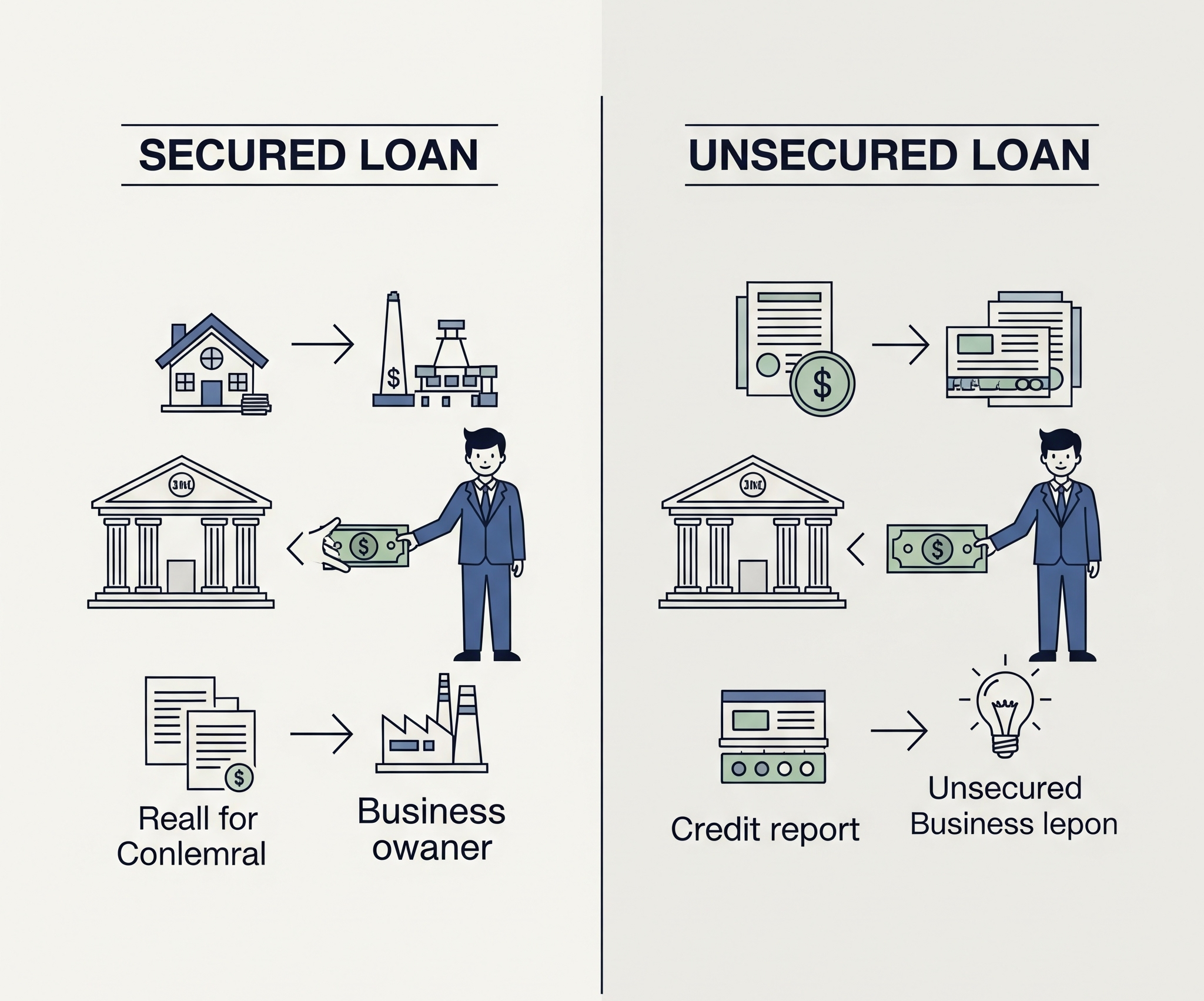

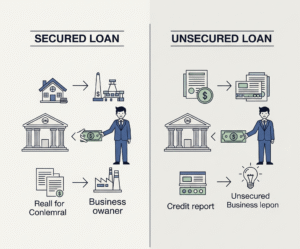

A secured business loan is a type of financing where you offer an asset—known as collateral—to back the loan. It reduces the lender’s risk, which usually translates into more favorable terms for you.

How Do Secured Business Loans Work?

It’s simple. You put up something valuable—like real estate, equipment, or even inventory—as a guarantee. If you can’t repay the loan, the lender can seize that asset. Because of this reduced risk, lenders are more likely to say “yes.”

Benefits of a Secured Business Loan

Lower Interest Rates

One of the biggest perks? Low-interest secured business loans. Lenders are more comfortable offering lower interest rates on the loan because it is secured by collateral. That will save you money over time.How to Get a Secured Business Loan

Higher Borrowing Limits

You can often borrow more than with an unsecured loan—especially if your collateral is valuable. This is perfect if you’re planning major expansions or need significant capital.

Longer Repayment Terms

When you get a secured loan, lenders typically give you more time to pay it back, making the payments easier to manage.

Common Types of Collateral

Real Estate

A substantial loan can be secured by using residential or commercial real estate. It’s stable and valuable—ideal from a lender’s perspective.

Equipment or Inventory

Your machinery or unsold inventory can serve as collateral for product-based businesses.

Personal Assets

Yes, you can use personal assets like your home or car—but be cautious. There are dangers in combining personal and business assets.

Who Should Consider a Secured Business Loan?

Startups

Startups are frequently rejected by banks due to their lack of experience. But the best secured business loans for startups offer a chance to secure capital with assets like equipment or savings.

SMEs

Secured SME loans for new businesses are tailored for small to medium enterprises. These businesses typically have some assets but require additional capital to expand.

Businesses with Bad Credit

Even if your credit score is less than stellar, secured business loans with bad credit are still within reach—collateral gives lenders peace of mind.

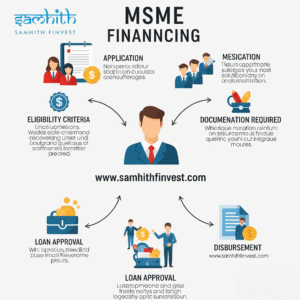

How to Qualify for a Secured Business Loan

Improve Your Business Credit Score

You can get better terms with a good credit score, even though the loan is secured.How to Get a Secured Business Loan

Pay off debts, keep utilization low, and check your credit report regularly.

Prepare Solid Financial Statements

Lenders want to see your business is financially healthy. Prepare balance sheets, income statements, and cash flow projections in addition to cleaning up your books.How to Get a Secured Business Loan

Choose the Right Collateral

The more valuable and liquid your collateral, the better your chances. Lenders prefer assets that are easy to evaluate and resell if necessary.

Step-by-Step Guide to Getting a Secured Business Loan

Step 1: Assess Your Business Needs

Know exactly how much you need and why.How to Get a Secured Business Loan

Are you expanding, hiring, or investing in new tools?

Step 2: Evaluate Collateral Value

Assets are not created equal. Have your collateral appraised or get a fair market estimate to know your leverage.

Step 3: Research Lenders

Different lenders offer different perks. Compare online lenders, credit unions, and banks. Look for transparency, flexibility, and speed.

Step 4: Gather Documentation

Typical documents include tax returns, bank statements, business licenses, and proof of ownership for the collateral.

Step 5: Apply and Negotiate Terms

Don’t just take the first offer. Negotiate the interest rate, repayment term, and any fees involved.

Best Secured Business Loans for Startups

Government-Backed Loans

Think SBA loans. They’re designed to help startups and are partially guaranteed by the government, reducing the lender’s risk.

Online Lenders

Some fintech companies specialize in offering secured business loans to startups—often with faster approval times and more flexibility.

Traditional Banks

These usually have the lowest interest rates, but the requirements are more stringent. Your chances are improved with a solid business plan and useful collateral.

Low-Interest Secured Business Loans

How to Find Them

Start by checking with local banks and credit unions. Then compare rates online using aggregator sites. Don’t forget to investigate the SBA loan programs as well.

Tips to Qualify for Lower Rates

- Maintain a good credit score

- Offer high-value collateral

- Ensure regular revenue

- Keep debt-to-income ratio low

Secured SME Loans for New Businesses

Tailored Options for SMEs

Many lenders offer loans designed specifically for small businesses. These come with more realistic repayment plans and lower entry requirements.

Eligibility Criteria for SME Loans

You’ll usually need:

Evidence of company registration

6-12 months of financial records

At least 70-100 percent of the loan’s collateral value

Getting a Secured Business Loan with Bad Credit

How to Boost Approval Chances

Make good use of collateral

Make use of a cosigner.

Show strong business cash flow

Create a convincing loan application.

Alternative Lenders for Bad Credit

Non-bank lenders, online platforms, and community development financial institutions (CDFIs) often say “yes” when traditional banks say “no.”

Mistakes to Avoid When Applying

Overestimating Collateral Value

Always get a professional appraisal. Lenders will do their own, and a mismatch can derail your application.

Ignoring Loan Terms

Don’t focus only on the interest rate. Examine the fees, penalties, and adaptability of the repayment terms.

Post Comment